What to expect from Apple's 2022 holiday quarter earnings report

Apple will be announcing its 2023 fiscal first quarter results on February 2. Here’s what to expect from the holiday quarter earnings — and what Wall Street is predicting.

Apple revealed on January 4 that it will be holding its investor call on Thursday, February 2, at 2:00 PM Pacific, 5:00 PM Eastern, to discuss the first fiscal quarter earnings release from earlier in the day. Based on the usual timeline for results, details should be released by Apple about half an hour before the call itself.

For the call, CEO Tim Cook and Luca Maestri will discuss the health of Apple over the last three months, including product launches and sales, negative events, and other economic headwinds that could affect the quarters to come.

As usual for Apple since the start of the pandemic, the company hasn’t offered formal revenue guidance for the quarter at the time of its previous earnings report.

Earnings for the quarter are typically the highest due to Apple’s highly seasonal sales, as well as a list of key product launches.

During the period, the iPhone 14 generation, second-generation Apple Watch SE, Apple Watch Series 8, Apple Watch Ultra, second-generation AirPods Pro, tenth-generation iPad, 6th-generation iPad Pro, and the third-generation Apple TV 4K were introduced by the company.

However, unusually for the quarter, Apple did issue an uncharacteristic notice about iPhone production in November. Due to COVID-19 issues at Foxconn’s Zhengzhou factory, the supply of the iPhone 14 Pro and iPhone 14 Pro Max was interrupted, prompting Apple’s notice.

At the time, the press release admitted the factory operated at a “significantly reduced capacity,” though it has since caught up. Apple also said it continued to see “strong demand” for the Pro models, but also expected lower shipments and longer wait times for customers.

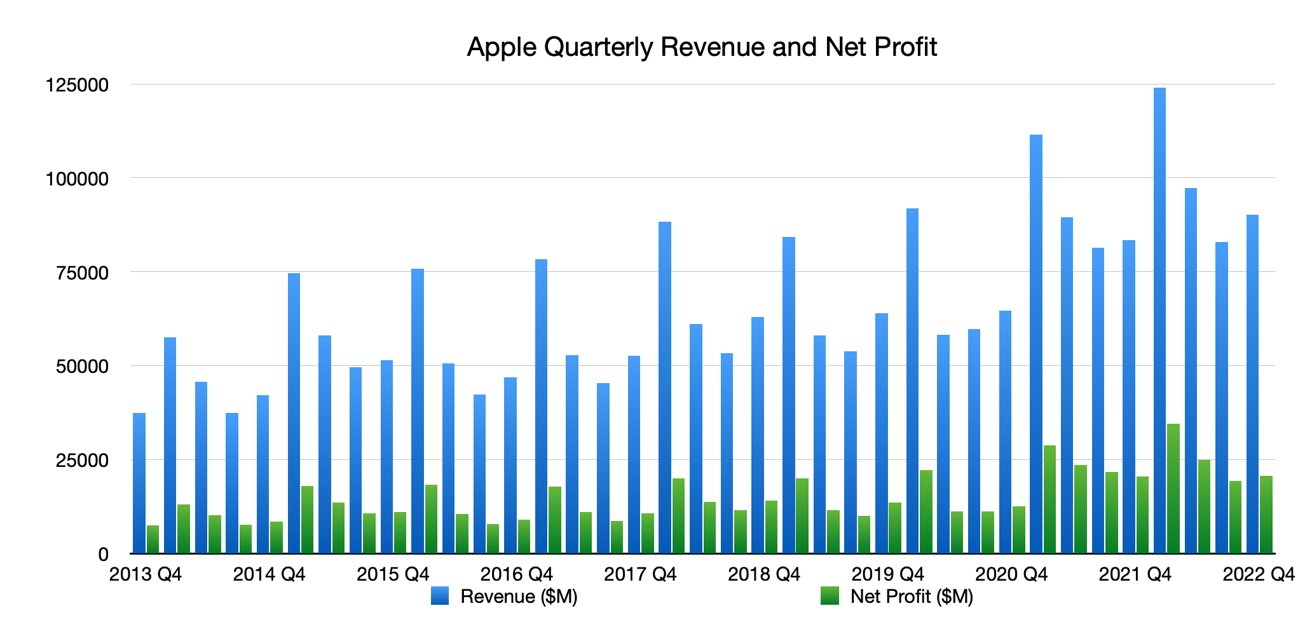

Apple’s Q1 2023 figures have to beat considerably high figures reported one year ago in Q1 2022. At that time, it reported an 11.2% YoY increase in revenue to $123.9 billion, with a net profit of $34.6 billion also record-setting and an annual increase of 20.4%.

For Q1 2022, the iPhone brought in $71.6 billion in revenue, with Mac revenue also up to $10.8 billion in the quarter. Wearables, Home, and Accessories was up to $14.7 billion in revenue, Services saw a YoY increase to $19.5 billion, but iPad revenue saw a drop down to $7.2 billion.

What is the Wall Street consensus on Apple’s holiday quarter?

As of January 23, the analyst consensus for the quarter is an earnings per share of $1.95. This translates into a quarter with $122 billion in revenue. This compares to $123.9 billion in the year-ago quarter.

Consensus for the next quarter’s revenue is presently sitting at $98.2 billion, but most of the analysts in question chimed in before the release of the new Mac Pro, updated Mac minis, and a second-generation large HomePod.

Individual analysts on Apple

The iPhone 14 Pro shipment problems were a point of issue for analysts examining the company’s fortunes, with lower shipment forecasts of the models thought to heavily impact revenue. However, some offered the view that shipments would be pushed into Q2 2023 sales instead.

At one point in January, Apple’s market capitalization dipped below $2 trillion, with investors wary of the supply chain problems and listening to analyst discussions on the company’s fortunes.

Daniel Ives and John Katsingris, Wedbush

Wedbush lowered its price target for Apple from $200 to $175 on January 4, on the basis of it being a more “uncertain environment” for trading, and over demand headwinds.

“Apple remains our favorite tech name,” the firm said while insisting it maintains its “Outperform” rating for the stock, but supply chain checks were “clearly mixed heading into the next few quarters,” with Apple also apparently cutting back some orders for products.

On iPhone, demand for the iPhone 14 Pro is more stable than feared, and that there is a belief that the “overall demand environment is more resilient than the Street is anticipating.”

Samik Chatterjee, JP Morgan

On January 19, JP Morgan warned investors it believes demand is falling slightly across the entire Apple product catalog. Viewing the earnings as a “tough setup” due to supply headwinds, the worries turned into “demand concerns for the Mar-Q and beyond,” the firm believes.

Revenue and earnings for the first quarter of 2023 will “track modestly below consensus expectations,” but the miss should be “more modest” than previously expected. JP Morgan also raised its December quarter estimates on supply tracking, but added that weakness in underlying demand will make the next quarter “equally tough.”

After lowering the price target in December 2022 from $200 to $190, JP Morgan went further in January, pushing it to $180.

Canaccord

A January 22 note had Canaccord Genuity Capital Markets cut its price target for Apple from $200 to $170, while reaffirming the “buy” rating for stock.

Demand for the Pro model iPhones has been disappointing, but believes some lost December sales will be pushed later into March. Recent channel checks indicate that a four-week wait for the premium models has all but evaporated.

Overall demand has been slowing despite a strong sell-through for iPhones, it adds, which presents a more pessimistic view for 2023 as a whole. There’s a forecast of $68.3 billion for first-quarter iPhone sales, with a full-year estimate of $199.6 billion.

Other hardware is also at risk of a meaningful decline in demand, with the higher price points of new Macs making it hard for Canaccord to see if consumers still have a “willingness to invest in more expensive products” given a tough macro backdrop.

Rosenblatt

On January 13, Rosenblatt Securities reduced its price target by $24 down to $165, with iPhone production delays and “macro services headwinds” to blame.

A December survey found fewer people willing to buy or have bought an iPhone 14 than a similar survey in September, with buying intent for the iPhone 14 Pro Max reducing from 44% in September to 34% in December for that group.

Rosenblatt also echoed reports that the App Store has slowed down, including a double-digit percent drop in the December quarter following growth earlier in the year, which is “potentially reflecting weakening game revenues.”

Ultimately, the analysts expect improvements and offers that investors may view this “as a throwaway quarter” and to instead “focus on later periods.”

AppleInsider will be adding more analyst predictions before the earnings report.