Maximize your savings with the best tax software for 2023

You need to file your taxes, but you can make the intimidating and complex task much easier to swallow by picking up one of these tax software tools.

Completing your annual taxes can feel like a chore, with a complex list of rules to follow that can intimidate most people. Indeed, even tax professionals can sometimes need guidance through the process of maximizing deductions and increasing the potential refund.

To make your experience as pain-free as possible, we have rounded up the best tax software programs of 2023. We have compiled the best mobile-friendly tax software, minimizing your headache by laying out the pros and cons of each.

Our list takes into account the user’s comfort with tax filing, the simplicity of the software, the cost to file, and the best tax programs for simple or complex returns, depending on your needs.

Difference between simple and complex tax returns

Before you decide which software would best suit your needs, you must first figure out whether you have a simple or complex tax return.

A simple return generally means that you just have to file your W-2 income, your limited interest and dividend income, have a standard deduction, and any unemployment income.

If you have a complex return, it might mean you have freelance income that uses a 1099 tax form, income from overseas, income from investments and stock sales, or are a business owner or landlord.

If you have a simple return, each of the best tax software options below includes a free option to file. You can also check out our list of the top tax software deals available.

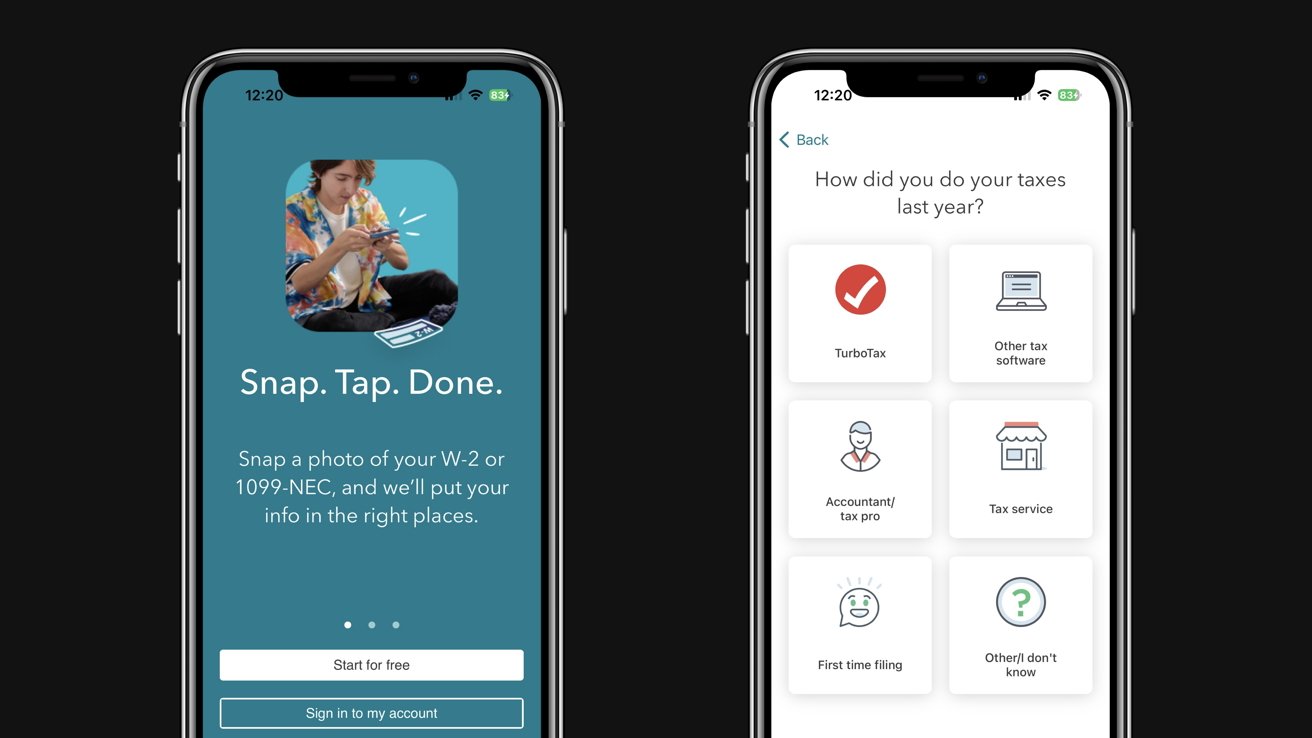

TurboTax

TurboTax takes the headache out of doing taxes. It stands out due to its stress-free user experience and easy, DIY design.

This is why TurboTax remains the industry tax standard as the best, all-encompassing software.

TurboTax streamlines its software with a Q&A guided format, asking the right questions to get you in and out of there, and with the biggest refund, as fast as possible. The “click here if this applies to you” section ensures you won’t waste time on paperwork.

It offers a free version for simple returns, as well as making things easy if you need to re-do a form. It can also import last year’s tax return, has options to upgrade throughout the Q&A process if you get stuck during filing, and does all of your calculations for you.

In addition, for those who prefer to do taxes on the go, TurboTax has a mobile app available from the App Store.

How to file your taxes with the TurboTax app

Some of us are die-hard file-from-my-computer-only kind of people. We get it — we want to file taxes only once — correctly and accurately.

If you’d like to try filing on your phone this year, you can use the app to file using your iPhone or iPad, or even switch back and forth between TurboTax Online and the app.

The user interface is clean and doesn’t differ much from the desktop version. It is simple, safe, and secure to file your taxes with the TurboTax app.

TurboTax pros

- Q&A guidance interface is easy to use, with explanations as you go

- Free tax software version available for simple tax returns only

- Live tax option starts at $130 for Basic and goes up to $260 for Premier and Self-employed

- Limited-time deal for 2022/2023, Live Basic (including assistance from tax experts) is free for simple tax returns; must file by 3/31

- A+ rating from the Better Business Bureau

- Mobile app available

- For hairier IRS issues, Audit support is available

- The Live Full Service Option has a tax expert prepare, sign, and file your return

TurboTax cons

- Sheer amount of questions might become overwhelming

- Live support costs extra

- More expensive than other programs

TurboTax plans and prices

Free: $0 for federal and state. Deluxe: $60 plus $50 for state. Premier: $90 plus $50 for state. Self-employed: $120 plus $50 for state.

The TurboTax app is free to download from the app store, is compatible with iOS 14 or later, and is a 376.2 MB download.

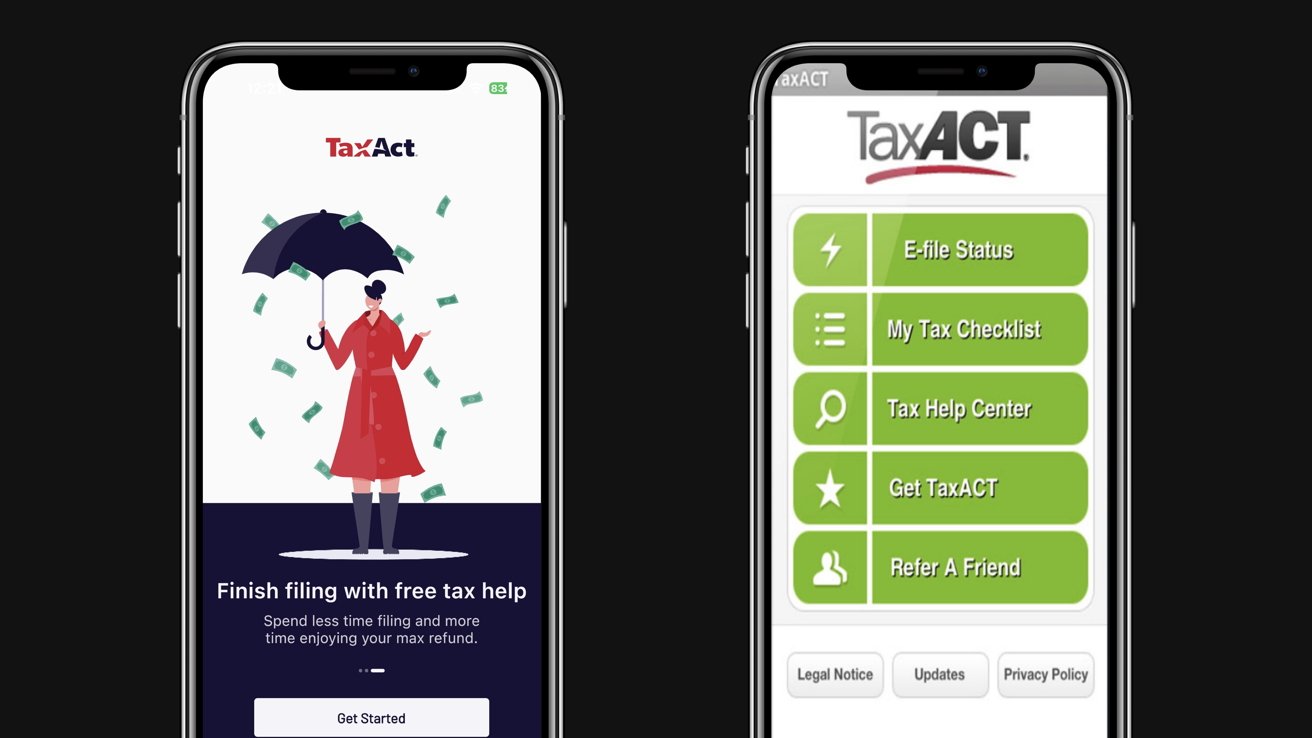

TaxAct

While TurboTax and TaxAct both offer assistance, searchable knowledge bases, and tech support, TaxAct gives every filer help for free, while TurboTax comes with a fee.

How to file your taxes with the TaxAct Express app

If you don’t already have it, download TaxAct Express on your iPhone and create an account to get started.

With the TaxAct Express app, prepare your federal and state tax return using your iPhone or tablet.

TaxAct pros

- More affordable than other paid software

- Live tax option starts at $35 for Basic and goes up to $139.95 for Self-employed

- Regardless of tier, free help is available through the Xpert Assist feature

- Free review of your return before filing

- Tap Maximum refund and accuracy guarantee, or will TaxAct will refund plan fees and pay any difference in the refund or tax liability, plus cover legal or audit costs up to $100,000

TaxAct cons

- Free version won’t work if you deduct student loan interest, deduct mortgage interest, report business or freelance income, or report stock sales or income from a rental property.

- Even the free plan charges per state return

TaxAct plans and prices

Basic: $0 plus $4.95 for state. Deluxe: $24.95 plus $44.95 for state. Premier: $34.95 plus $44.95 for state. Self-employed: $64.95 plus $44.95 for state.

The TaxAct Express app is free to download from the app store, is compatible with iOS 14 or later, and is an 86.2 MB download.

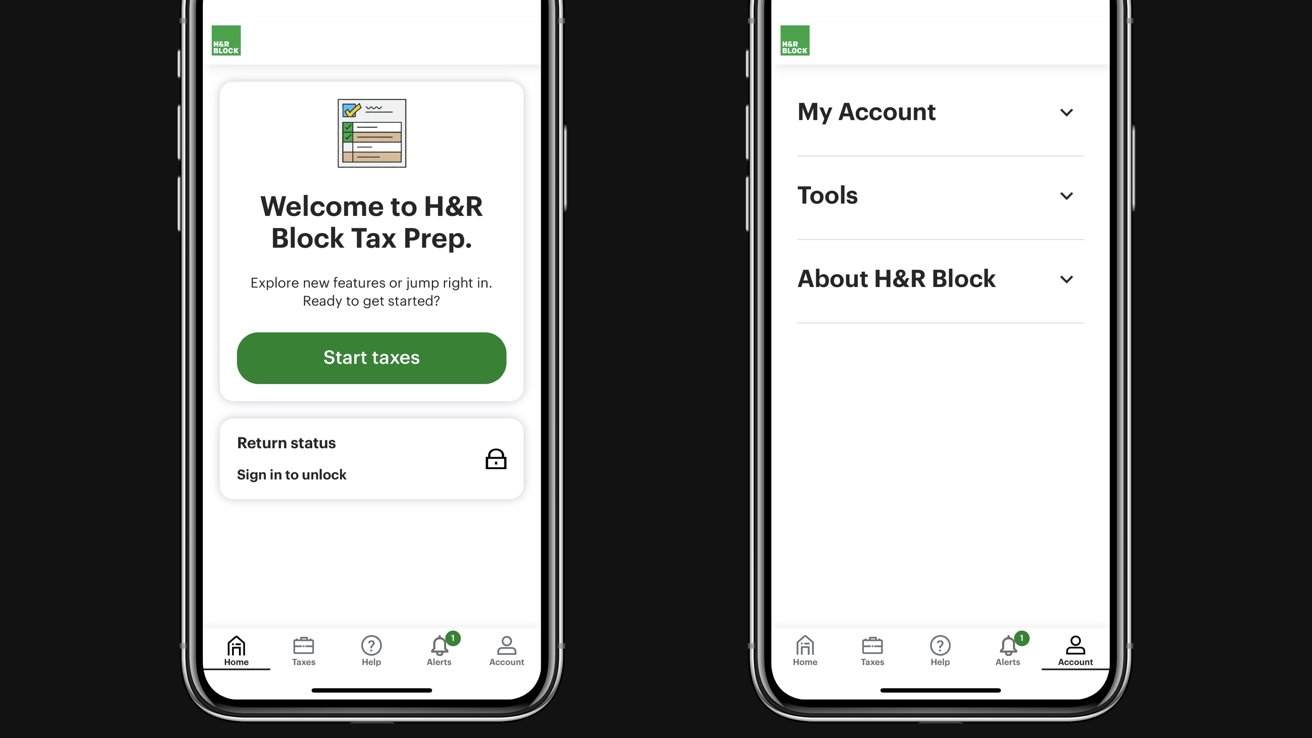

H&R Block

The main difference between H&R Block and TurboTax is the price. If you have a more complex return, H&R Block’s do-it-yourself options are less pricey than TurboTax’s.

Compared to TurboTax, H&R Block’s interface is less cluttered. The tax preparation software asks you to fill in the basics for each section, such as income and then deductions, before moving forward, rather than jumping all over the place.

H&R Block has thousands of physical locations in the US. If you prefer to complete your taxes in person, H&R Block would be the clear choice compared to DIY online software.

If doing your taxes with a professional in person doesn’t suit you, you also have the option to complete your taxes yourself online.

How to file your taxes with the HRB TaxPrep app

If you don’t already have it, download H&R Block’s HRB TaxPrep on your phone and create an account to get started.

Fill out the prompts to file your taxes.

H&R Block pros

- Mobile app available

- A+ rating from Better Business Bureau

- Free version for simple returns

- Simple step-by-step guidance

- Over 11,000 physical locations (chances are you’ve driven by one in your city)

- 100% accuracy guarantee; H&R Block will reimburse you for penalties or interest up to 10,000

H&R Block cons

- Live support costs extra

- Pricier than other software programs: speaking to a live professional will run you at least $69.99 for federal returns, with additional fees for state

H&R Block plans and prices

Free: $0 for federal & state. Deluxe: $55 federal plus $37 for state. Premium: $75 federal plus $37 for state. Self employed: $110 federal plus $37 for state.

The H&R Block Tax Prep app is free to download from the app store, is compatible with iOS 11 or later, and is a 59.3 MB download.

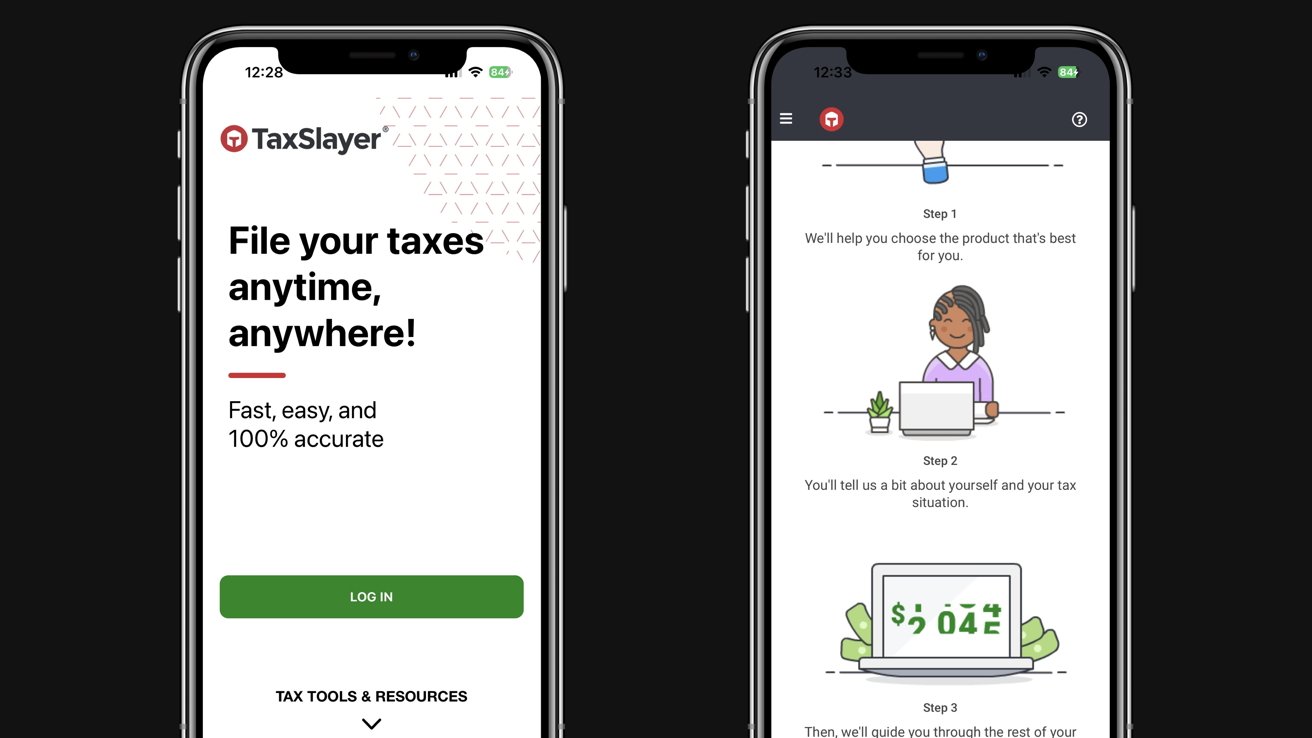

TaxSlayer

If you are a tax pro and don’t need extra help, TaxSlayer is the no-fuss option for you. Unlike TurboTax, TaxSlayer is a smaller-scale preparation service with a family business feel, offering its services at a much lower cost than other software programs.

How to file your taxes with TaxSlayer app

If you don’t already have it, download TaxSlayer on your phone and create an account to get started.

Follow the prompts, and prepare your federal and state tax return using your iPhone or tablet.

TaxSlayer pros

- Free version available

- Mobile app available

- A+ rating from the Better Business Bureau

- Cheaper plans for those with more complex tax returns

- Free service for active military members

- Maximum refund guarantee and accuracy; plan fees will be refunded if there is an error

Taxslayer cons

- Fewer features than TurboTax — could be a pro or con depending on your tax preparation familiarity

- No live tax option

TaxSlayer plans and prices

Free: $0 Classic: $17 plus $32 for state. Premium: $37 plus $32 for state. Self-employed: $47 plus $32 for state.

The TaxSlayer app is free to download from the app store, is compatible with iOS 14 or later, and is a 10.2 MB download.

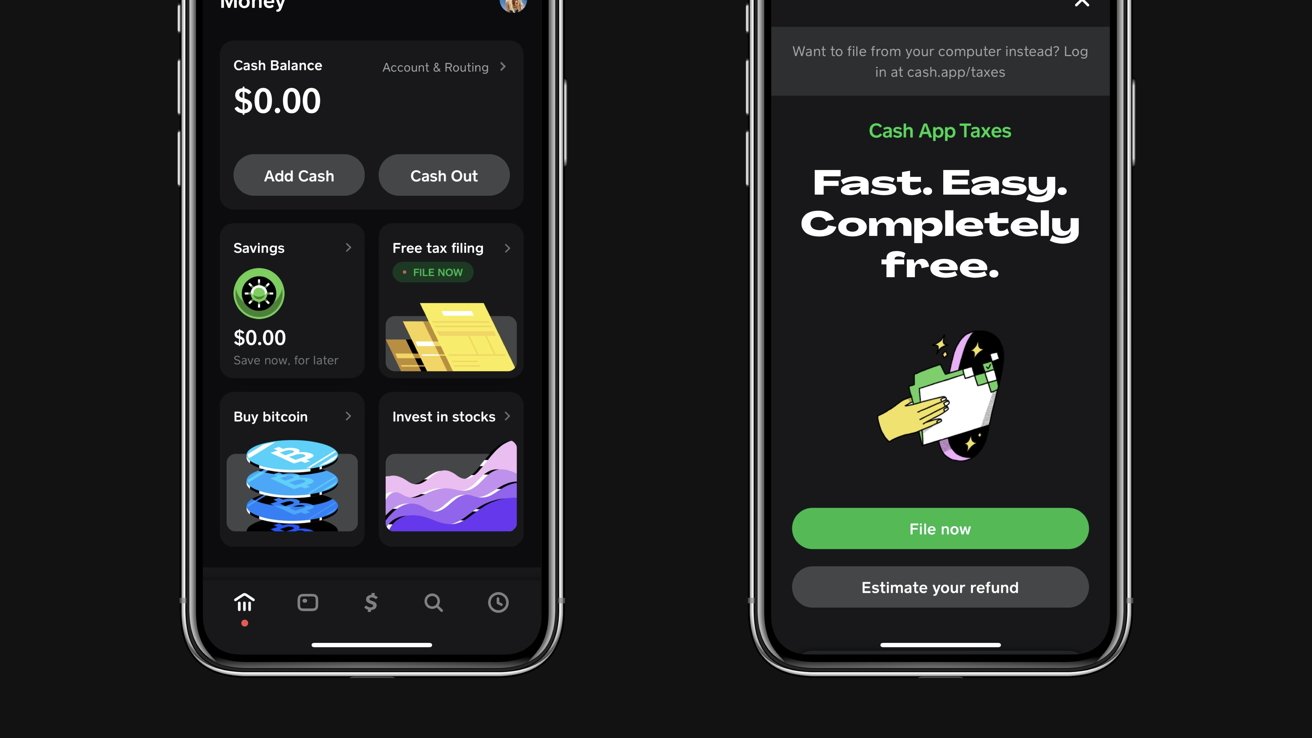

Cash App Taxes (formerly Credit Karma)

Like TaxSlayer, Cash App Taxes is for those who have a certain familiarity with the tax world already. Unlike other aforementioned tax software, it is the only service that offers completely free federal and state filing to all users.

In fact, paid upgrades are nonexistent, meaning you won’t be prompted to pay at any point of your service if you remember that you have a 1099 or need to itemize your deductions.

Cash App Taxes is ideal for those who received income from employment or self-employment, bank interest, or a business. If you’re skeptical as to how this software remains free, Cash App Taxes recommends financial products to its users, like loans and cards.

If the user chooses to take advantage of one of the offers, Cash App Taxes pockets some money from that partner.

However, note that it will warrant a bit more work on your end. This is why tax familiarity is important if you choose to use this software.

If you filed with different software last year, Cash App Taxes allows you to easily import last year’s return from H&R Block, TurboTax, and TaxAct.

How to file your taxes with the app

If you don’t already have it, download Cash App on your phone and create an account to get started.

After downloading Cash App, you’ll be able to file your taxes from the app’s home screen, or on your computer at cash.app/taxes.

Cash App Taxes pros

- Free, with no paid upgrades

- Cash App Taxes also 100% guarantees the accuracy of its calculations

- Cash App Taxes offers mobile tax preparation for federal returns and certain state returns

- Audit support is included

Cash App Taxes cons

- No individualized help — self-prepared only

- Only available in 40 states

- As of 2023, the Cash App Taxes does not support importing investment data

- While it accommodates most tax forms and situations, it may not be suitable for those with unique situations (like those with foreign income or those who’ve worked in multiple states)

Cash App Taxes plans and prices

It will cost the user $0 to file a federal and state return with Cash App Taxes.

Cash App is free to download from the app store, is compatible with iOS 14 or later, and is a 397.1 MB download.

2023 tax filing deadline

Regardless of the best tax software you use, tax filers have been able to submit their taxes since January 23, 2023. The deadline to submit your taxes is April 18, 2023.