5 tactics for managing paid customer acquisition during a downturn

5 tactics for managing paid customer acquisition during a downturn

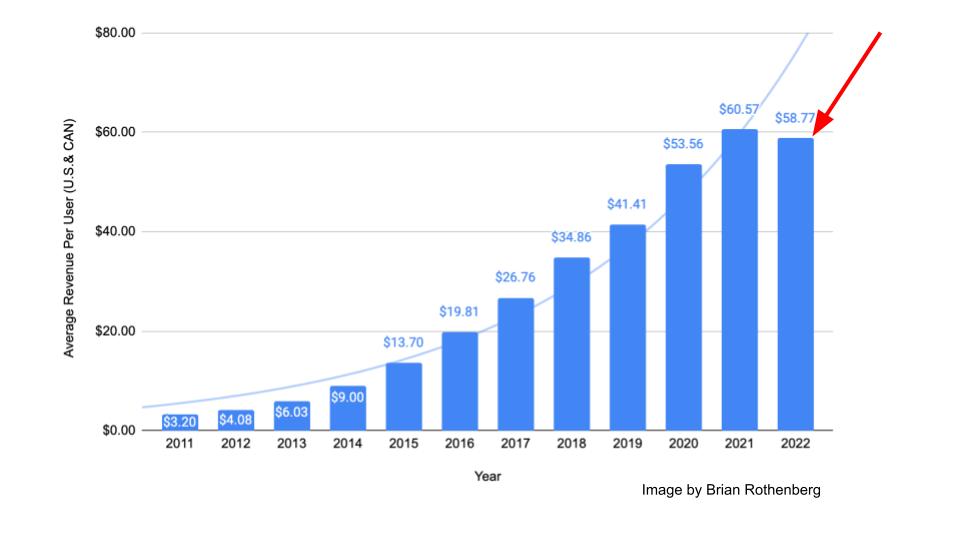

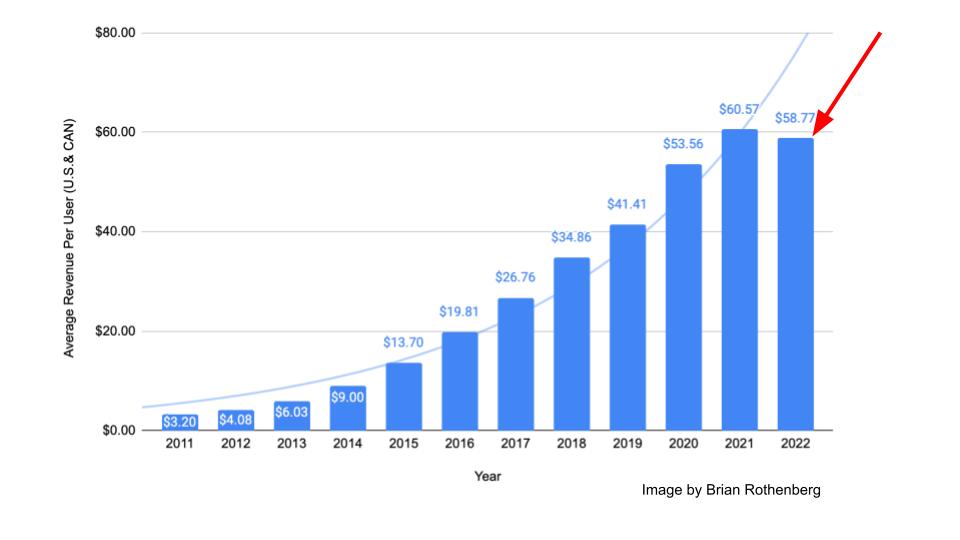

From 2011 to 2021, Facebook’s average revenue per user (ARPU) shot up at a nearly exponential rate. Companies across every sector were paying more per “eyeball” than ever as customer acquisition costs (CAC) rose at an unsustainable rate.

I shared this observation a couple years ago, predicting that startups would start to better scrutinize and reel in their spending:

My timing was off by three years, but we’re finally seeing this play out. For the first time on record, in 2022, Meta’s ARPU actually declined from a year earlier in the U.S. and Canada.

Image Credits: Brian Rothenberg

I spent most of the last decade as a startup operator, working through these challenges leading growth at my startup, then at TaskRabbit and Eventbrite as VP of growth and as a growth adviser. Now, as an early-stage investor, I spend much of my time helping companies navigate and chart their own growth paths.

Advertising costs had risen for nearly my entire operating career, so I biased heavily toward developing scalable organic channels and building in-product growth loops. But as a founder during the Global Financial Crisis and subsequent recession, I learned how a broad market pullback in online ad spending can create opportunities for startups willing to double down when others are running for the exit.

At my prior startup, we worked to build a growth engine of unique, user-generated content that fueled organic SEO growth and experimented across Google, Facebook and other paid online channels. This let us find channels and tactics that drove compelling CACs, and we used this spending during that downturn to ramp up our early user base more quickly. We also learned faster by having more people using our product than we otherwise would have.

Fast-forward to today: Against the backdrop of inflation, the stock market in 2022 saw its worst drop since 2008, and companies are laying people off while tightening their purse strings. Ad spending is one of the first areas to be cut, which is why we saw the first pullback in Meta’s ARPU in more than a decade.

It sounds gloomy because it is so. But for opportunistic companies, there’s a silver lining: Now is a great time to go on offense.

During a recent board meeting at a startup, our eyes widened when we saw their paid CAC had dropped to the single digits. Their payback was immediate for each new customer they acquired (as a benchmark, immediate payback is “exceptional”). A good portion of the ensuing conversation revolved around the CEO’s question: “Should we invest more aggressively in this acquisition opportunity despite the broader market challenges?”

I’ve since had similar conversations with other companies, and while each situation is unique, I wanted to share my high-level advice:

Five ways to strategize paid marketing in a downturn

1. Consider if paid marketing is the right investment for you right now

Ask yourself: “Is paid marketing really the place to invest our precious cash when we factor in the new reality of our cost of capital?”

Capital is more expensive now than it’s been in years. Where else can you invest to drive higher returns and to build a more durable competitive advantage?

It’s important to recognize that paid advertising is arbitrage: You pay to acquire a customer for less than their value. While the current downturn is driving ad costs lower, presenting a near-term opportunity, this spread is shrinking over the medium term as competition increases and as the dominant platforms (Meta, Google and the like) squeeze more money out.