An exciting new lineup of smartphones is on the horizon… for Europe at least

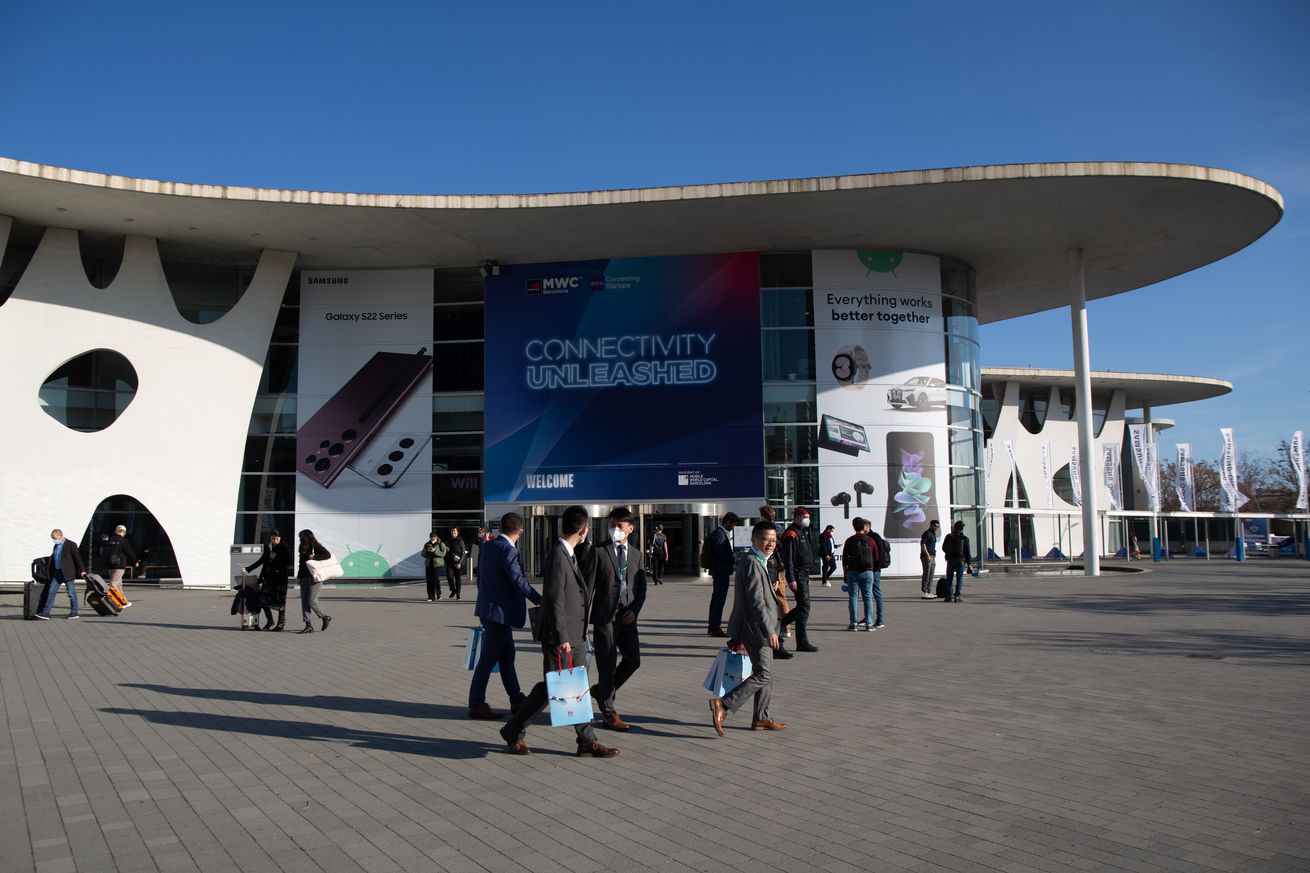

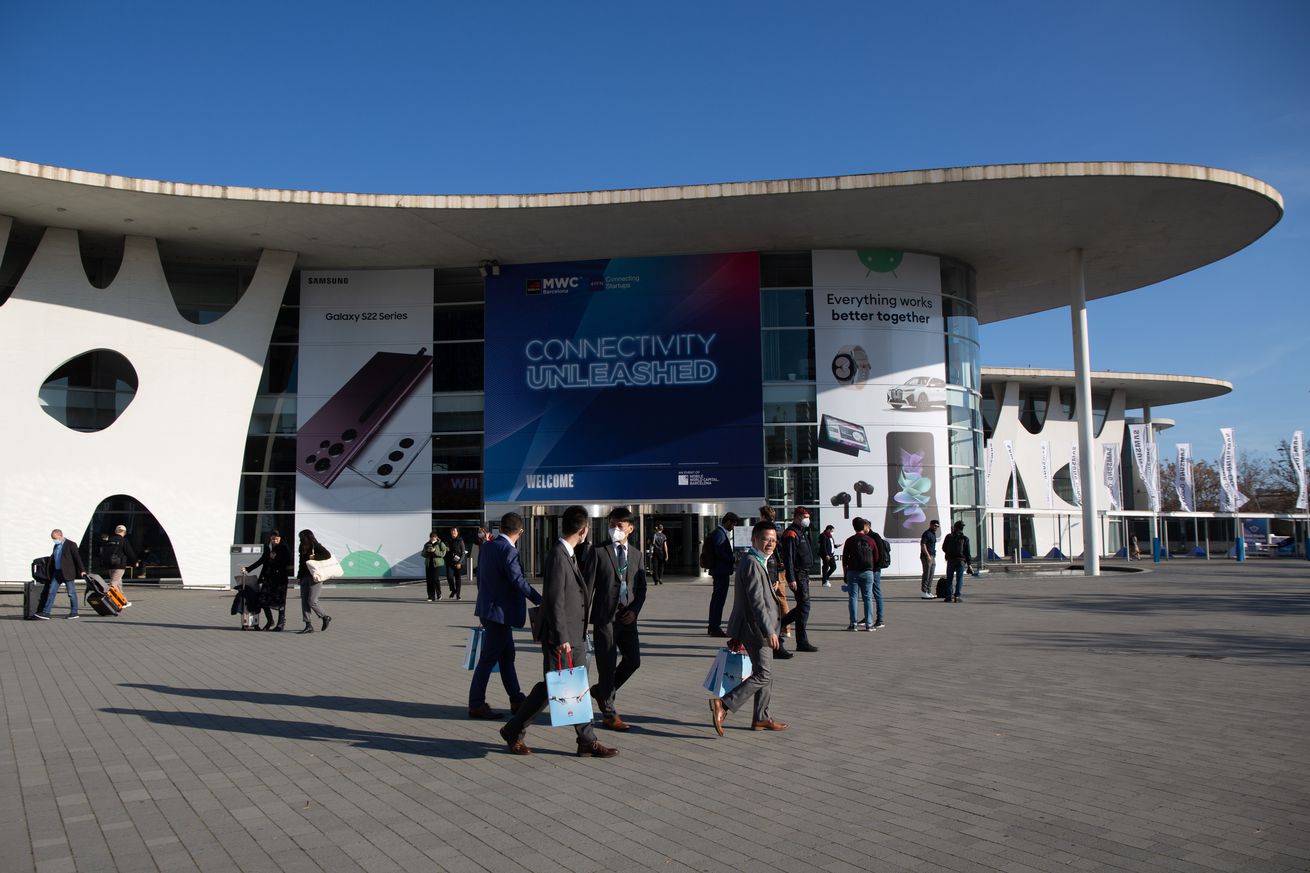

In less than a week, some of the world’s biggest mobile players will be crowded into the Fira de Barcelona convention center, ready to show off their latest generation of mobile devices. In previous years, that’s meant everything from flagship smartphone announcements from Samsung and LG (RIP), smartwatches, and even the launch of the original HTC Vive.

These days, however, things feel a little different. Despite the “World” in Mobile World Congress, MWC Barcelona feels increasingly focused on Europe. The global smartphone market has never been a cohesive whole, but the US and China feel more than ever like they’re diverging from everywhere else. And that’s left MWC in a weird spot.

I mean, just look at what we’re expecting from Honor, Xiaomi, and Realme:

- Honor — the international launch of the Honor Magic VS, a foldable device it released in China last November.

- Xiaomi — the international launch of the Xiaomi 13 Series, which was released in China two months ago.

- Realme — the announcement of the Realme GT3, which recently launched in China as the GT Neo 5.

In all three cases, these Chinese smartphone brands are all expected to reannounce handsets that have already been launched in their home market. And these “global” launch claims are unlikely to extend to the US, whose mobile market continues to be an effective duopoly made up of Apple and Samsung devices. Samsung hasn’t teased any announcements ahead of the show, and Apple has never seriously participated in wider industry events like these.

Compared to a decade ago, Chinese brands increasingly dominate the global smartphone market. Finland’s Nokia and South Korea’s LG were the second- and third-biggest mobile phone vendors in 2012, according to IDC, but as their smartphone brands have faltered and disappeared entirely, Chinese firms like Xiaomi and BBK Electronics (whose brands include Oppo, Vivo, and OnePlus) have picked up the slack.

Despite their successes internationally, these Chinese brands have struggled to break through in the US. But it’s not due to a lack of trying. Honor and former parent company Huawei attempted it half a decade ago, and Oppo subbrand OnePlus continues to sell its devices Stateside — even if its most recent OnePlus 11 handset isn’t sold via any of the major carriers. Lenovo continues to nip at Apple’s and Samsung’s heels via its Motorola brand, and there’s also TCL to consider, but neither has built up much of a market share.

“We have fully seen the importance of the Chinese market and we realize that we need to invest more in order to face the fierce competition”

As the importance of Chinese manufacturers has grown so, too, have the number of smartphones that debut in China, only to maybe receive a global release months later. China is not just home turf for these firms; it’s also a highly lucrative market that demands prioritization, as Oppo’s chief product officer and OnePlus co-founder Pete Lau explained in a roundtable interview last year. “We have fully seen the importance of the Chinese market and we realize that we need to invest more in order to face the fierce competition in this market,” Lau said through a translator, explaining the company’s decision to prioritize the launch of the OnePlus 10 Pro for China before the West.

Software also plays an important part in why China’s smartphone market has become so distinct from the rest of the world. Despite the number of Android phones sold in China, none of them ship with Google Mobile Services or the Google Play Store. That’s resulted in an app ecosystem that’s dominated by a few key local players like Tencent and ByteDance and distinct from what’s available internationally.

As Honor CEO George Zhao explained to me last year, it’s meant that Chinese manufacturers like Honor are able to collaborate with local developers to get their apps optimized for new form factors like foldables. “We have a very good relationship with the [China-based] app providers,” Zhao explains. The result is a Chinese foldables market with a much better app ecosystem, and companies like Xiaomi and Vivo have launched foldable devices that are yet to see a release outside the country. It’s a different story internationally, where apps for foldables face a classic chicken-and-egg problem — even if Samsung and Google are doing their best to turn things around.

The US smartphone market is an effective duopoly

At the other extreme, we have the US, a market that few phone manufacturers have the resources to break into, let alone compete seriously in. Take startup Nothing, whose CEO, Carl Pei, has been frank about why it skipped an official US release for its debut Phone 1 and why it’s only now in a position to attempt to break into the market. “When you make a smartphone for the U.S. you need to work with the carriers on certification and adapting some of their features into your OS,” Pei told Inverse in an interview last month. “We didn’t have the resources for that before and now we do.”

Pei’s former OnePlus partner Pete Lau alluded to similar challenges last year, when he described “the longer software development process required for products in overseas markets” that means OnePlus has to “go through the technical approvals from carriers before we can sell the products.” It’s another reason he says it makes sense to launch OnePlus phones like the 10 Pro in China first before bringing them to the rest of the world.

It’s also worth remembering that Huawei was starting to overtake both Apple and even Samsung before national security concerns prompted the US government to sanction the Chinese tech giant and kill the international competitiveness of its excellent Android phones. Given the history, it’s perhaps unsurprising that Chinese firms might not be keen to become too reliant on the US market for sales.

That leaves MWC Barcelona a little stuck in the middle, filled with announcements of phones that are already publicly available in China and unlikely to ever see an official release in the US.

It’s not exactly a bad place for Europe to be in. The continent might not be swimming in premium foldables like China, but the release of devices like the recent Oppo Find N2 Flip and upcoming Honor Magic VS suggest that Chinese brands are prepared to give Europe a chance, even if they’re not prepared to make the jump to the US. And Europe still gets to benefit from Google’s all-important apps and services, which, despite its often chaotic approach to messaging, are still pretty great overall.

Of course, not everything announced at MWC Barcelona will be a rehash. Far from it. Here are some companies worth keeping an eye on:

- OnePlus is showing off a new concept device based on the OnePlus 11, which appears to have glowing blue light strips on the back and which the company describes as a “series of blood vessels.”

- Huawei hasn’t said much about what it plans to announce at MWC 2023 but told Fierce Wireless that it’ll be the Chinese tech giant’s “largest year” at the show. Last year, its most interesting announcement was the E Ink-equipped MatePad Paper, which was new for the show.

- Honor plans to announce the all-new Magic5 Pro in addition to launching the Magic VS foldable internationally.

- HMD — the Finland-headquartered company that produces Nokia phones — will be in attendance, even if it’s unclear what it might announce to coincide with the show.

Trade shows like MWC have always been a reflection of the industry they serve — which means that, in 2023, the event feels a little fractured and dominated by Chinese brands who, for a variety of reasons, are a no-show in the US. Europeans will be spoiled for choice, so it’s a shame the same degree of competition isn’t coming for any Americans tired of the Apple / Samsung duopoly.