Japan Officially Restricts Sales of Chipmaking Equipment to China

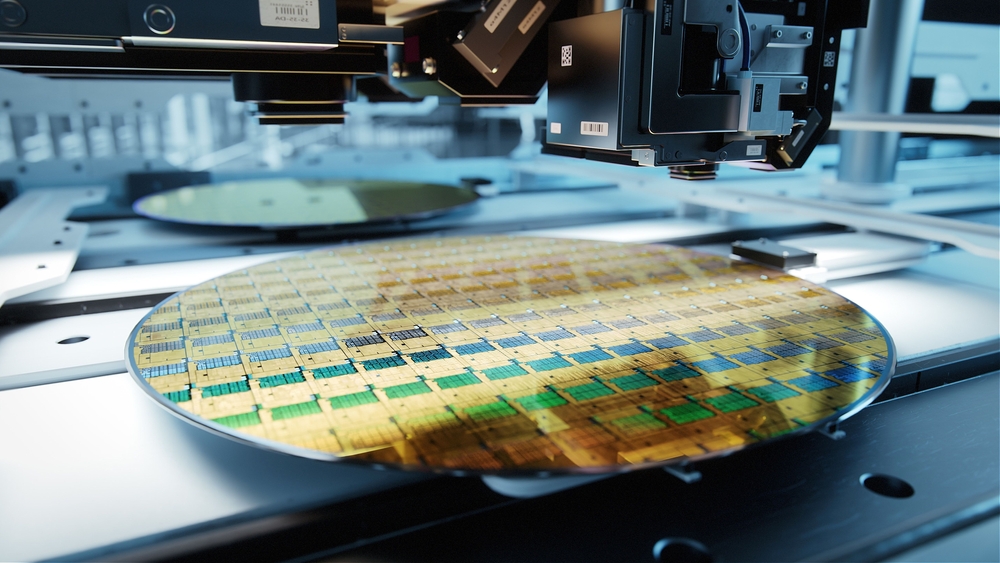

The Japanese government on Friday officially announced a list of 23 wafer fab tools that would be subject to export controls. This decision is expected to make it more challenging for Japanese high-tech companies to export these items to China, reports Nikkei. Specifically, Chinese foundry champion SMIC and NAND memory leader YMTC will not be able to procure the equipment they need to make advanced chips.

Among the 23 items subject to Japan’s export controls are all immersion lithography machines, etching equipment, tools used for chemical wafer polishing (and possibly post-CMP cleaning), and extreme ultraviolet (EUV) mask-testers, according to DigiTimes. These devices are made by ten companies, including Lasertec, Nikon, Screen Holdings, and Tokyo Electron. The updated regulation is expected to be formally declared in May and put into effect in July, so Chinese companies have at least three months to get the tools they might need.

The list of tools subject to Japanese export controls mimics restrictions imposed by the U.S. and the Netherlands against China in recent years. However, it is necessary to note that Japan does not directly name China (more on this below). The most recent export regulations imposed by the U.S. government limit the import of American tools and technologies used to create logic chips with non-planar transistors on nodes measuring 10nm/14nm/16nm or smaller, 3D NAND chips featuring 128 or more layers, and DRAM ICs with a half-pitch of 18nm or less. In addition, Amsterdam and Washington restrict tool sales that enable Chinese entities to use extreme ultraviolet (EUV) lithography.

The only company that can produce chips at advanced nodes that rely on FinFET transistors is Semiconductor Manufacturing International Corp. (SMIC). However, the company has historically focused on making chips on mature nodes and somewhat reduced efforts to build up advanced capacity after restrictions imposed by the U.S. government on equipment that can be used to build chips on 10nm-class or more sophisticated process technologies. The new restrictions by the U.S., the Netherlands, and now Japan will make it nearly impossible for SMIC to expand its 14nm capacity.

As for YMTC, it has already begun reducing its workforce after the restrictions imposed by the U.S. government in October, so the impact of the Japanese regulations on this 3D NAND maker is generally unclear.

The updated Japanese export regulation does not explicitly target China or any other specific country for regulatory measures, as Japan has a rather curious way of restricting sales of dual-use items to certain states.

Japan controls the export of certain dual-use civilian items under the Foreign Exchange and Foreign Trade Control Law. Items in the export controls list can be shipped without permission to 42 countries recognized as friendly or preferred trading partners (e.g., Singapore and Taiwan) but require an export license to be sold to countries that are not deemed friendly.

China is not on the list of ‘friendly’ countries, so from now on, Japanese companies will have to obtain individual permission to sell one of the listed 23 tools to a China-based entity.

However, Japan’s government believes that the impact of the new regulations will be limited.

“The targets to be covered by the export controls are not areas with large markets, and we believe that the impact on corporate performance will be limited,” said a senior trade ministry official, according to Nikkei.