Pitch Deck Teardown: Smalls’ $19M Series B deck

Smalls has raised a total of $34 million for its cat food subscription business. But in a competitive pet food market, how does the company set itself from its competition?

The cat food industry is an extremely competitive market, with numerous brands and products vying for the attention of cat owners. The industry is characterized by constant innovation, but largely on the marketing side, rather than on product. So where does a company like Smalls fit in? How does it know that it can continue growing? Let’s find out!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Smalls raised with a 24-slide deck, which it shared in full with us with some minor edits: “Information redacted includes specific details to the company’s valuation and current revenue,” a representative from the company told me but said that no slides were completely omitted.

- Cover slide

- Market slide

- Problem slide

- Mission slide (“We are here to make 9 lives 10”)

- Competition slide

- Product slide

- How it works slide

- Why Now interstitial slide

- Business metrics slide

- Milestones slide

- Team slide

- Use of Funds slide

- Performance interstitial slide

- CAC slide

- Go to market/growth channels slide

- Value Prop slide

- Churn analysis slide

- LTV slide

- Future Plans interstitial slide

- “From cat food brand to cat brand” — Market extension slide part 1

- Market extension slide part 2

- LTV extension slide

- The Ask and target milestones slide

- Thank you slide

Three things to love

A bunch of really great things stood out to me in this pitch deck, and I’m not just saying that because it includes adorable cat photos.

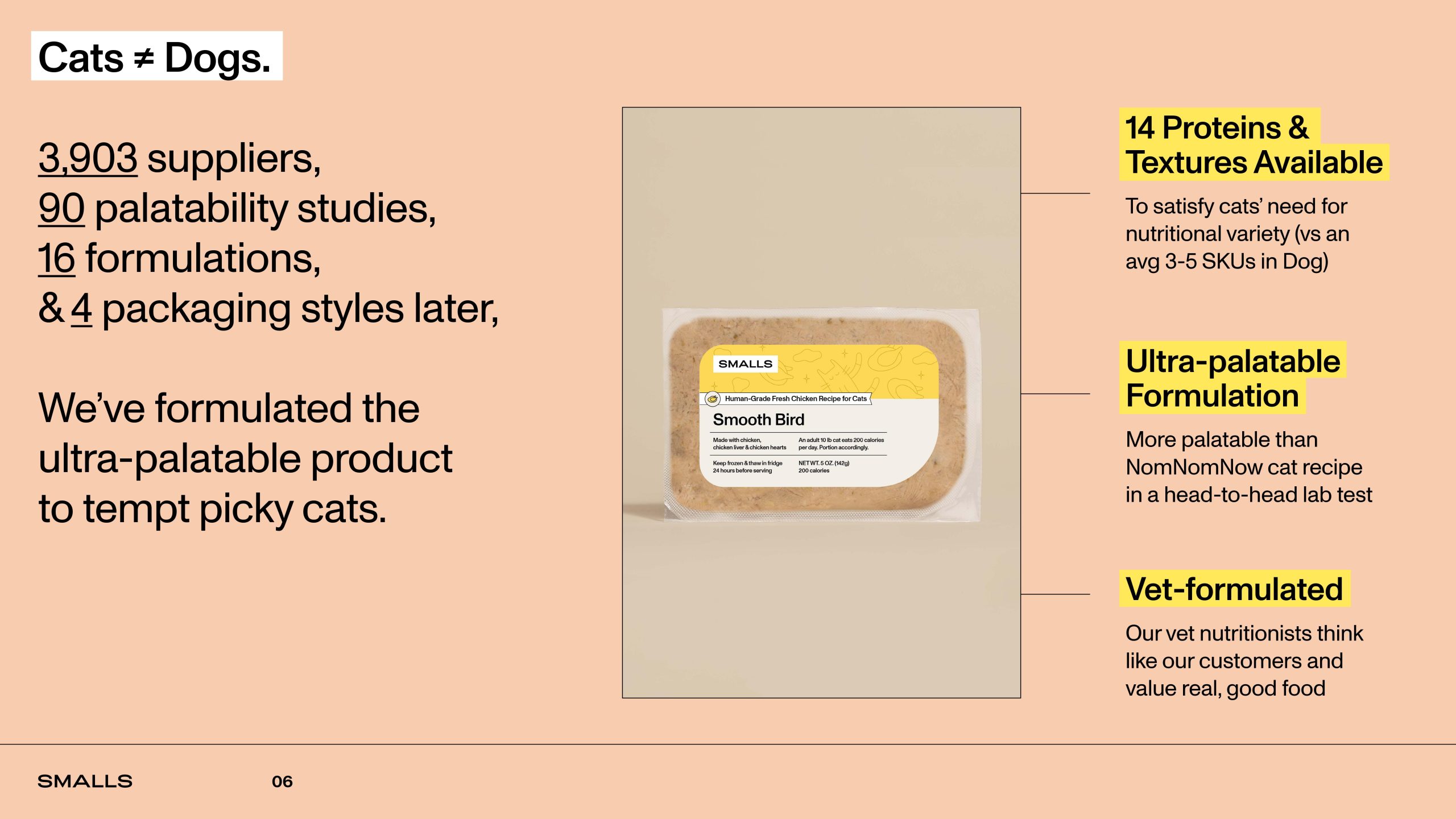

We get it, cats are picky eaters

[Slide 6] Well played. Image Credits: Smalls

It’s not uncommon for companies to discover opportunities for more aggressive growth, and it’s possible that’s why it decided to take more funds.

Smalls lays out why it has a purrfect fan base. Its remarkable spread of formulations (with hilarious names like fish, bird and other bird) and textures (smooth, ground) mean there’s something in there for everyone. It couldn’t have been logistically easy to end up with 14 different SKUs that need to be manufactured and kept in stock, but here’s a company that understands that animals don’t always eat what they don’t like, especially finicky cats. Having all of these formulations already in-market represents a moat of sorts; it isn’t easy, which may just prove helpful in keeping competitors at bay.

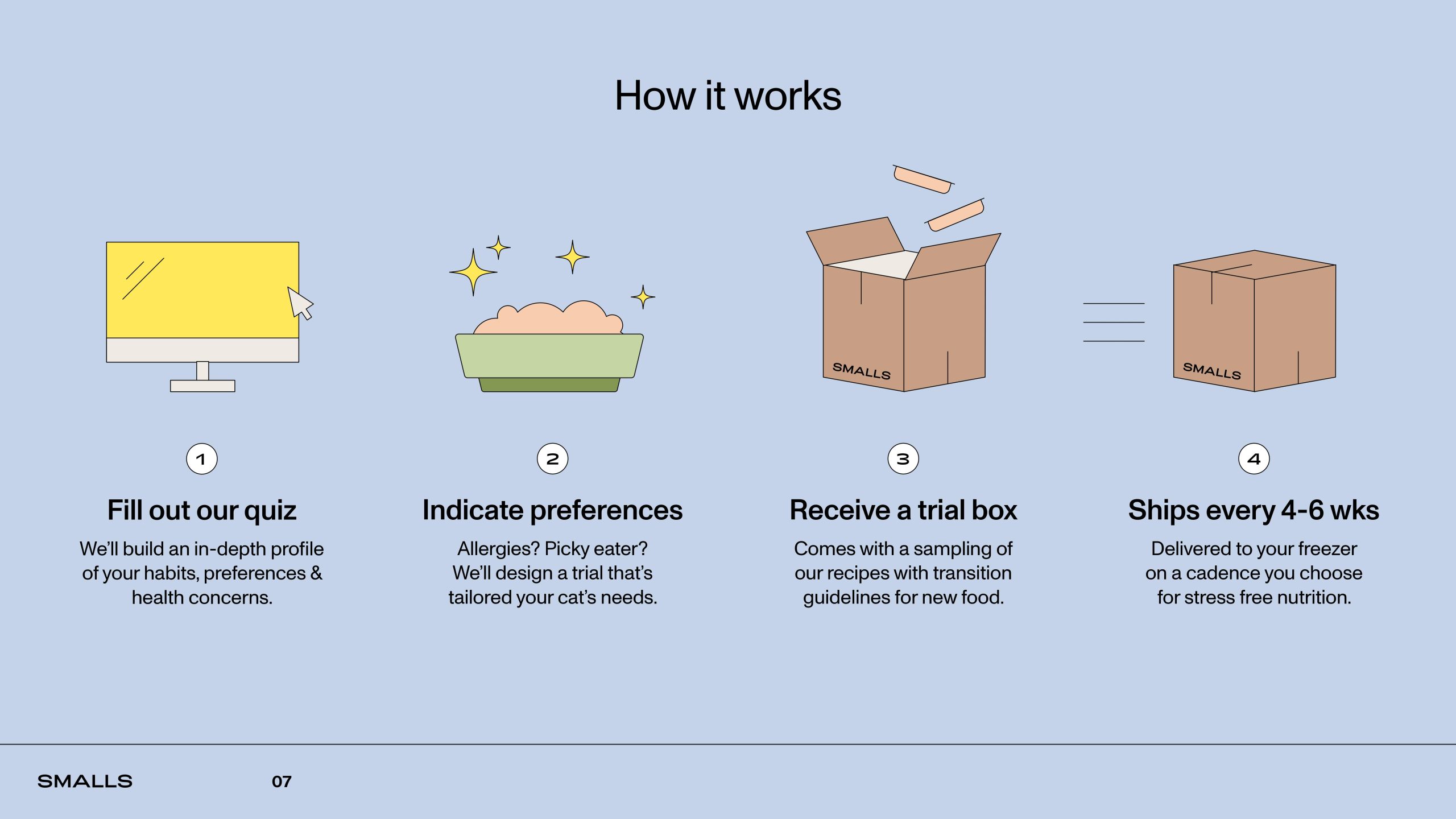

The way Smalls gets pet owners hooked is through its seamless ordering flow:

[Slide 7] A taster pack gets the cat dialed in. From there, you can choose to subscribe. Image Credits: Smalls

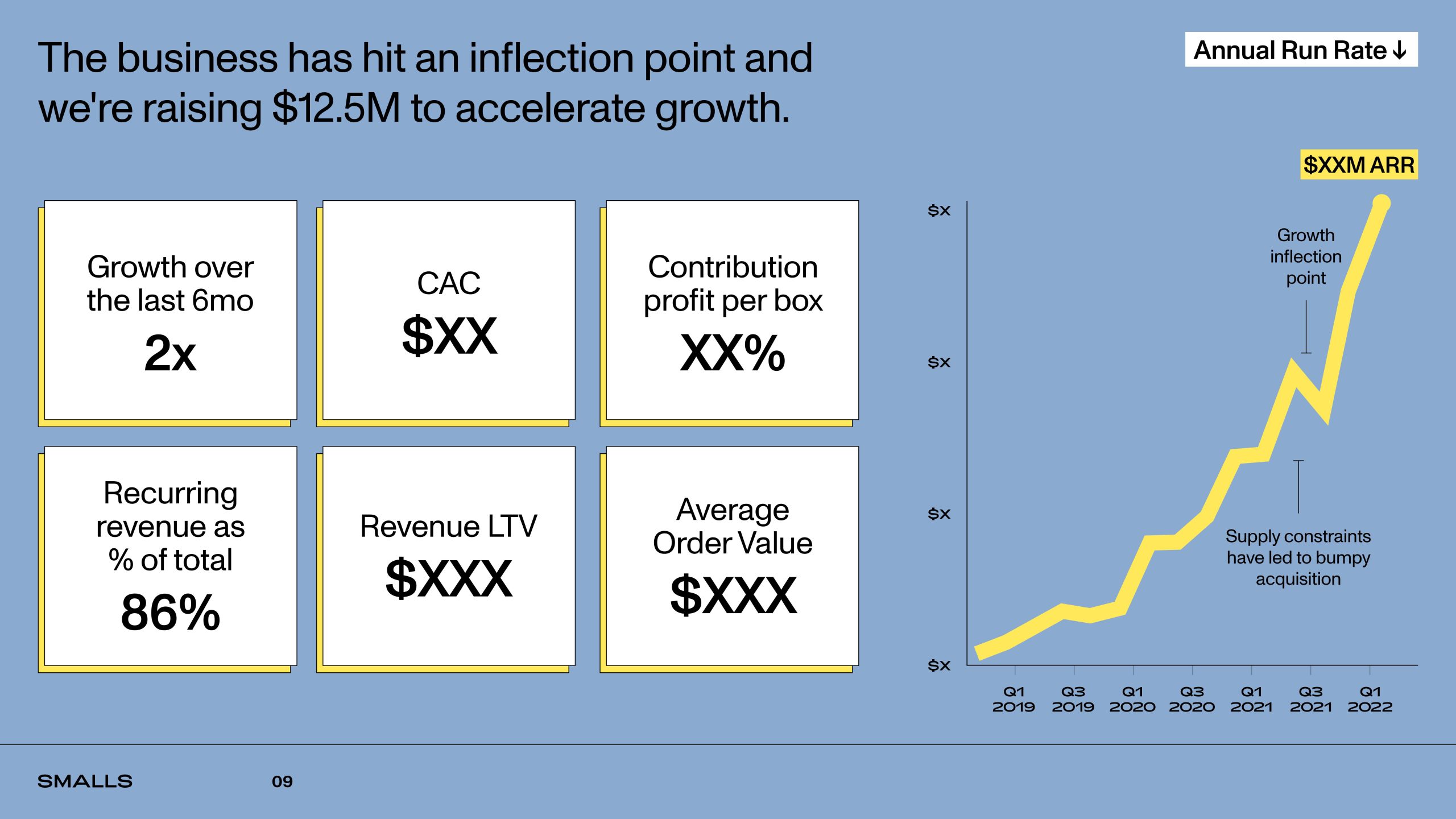

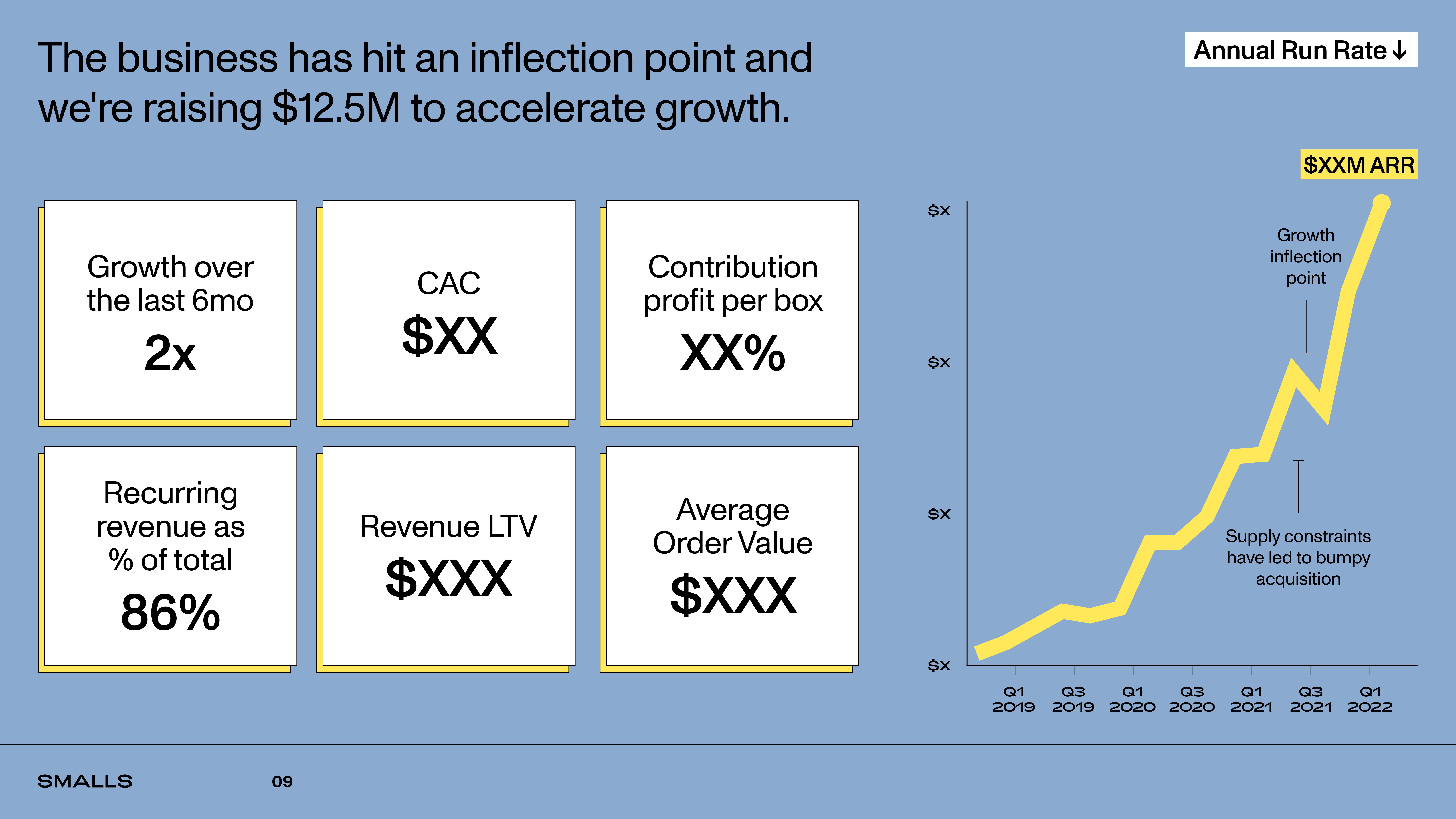

Solid metrics

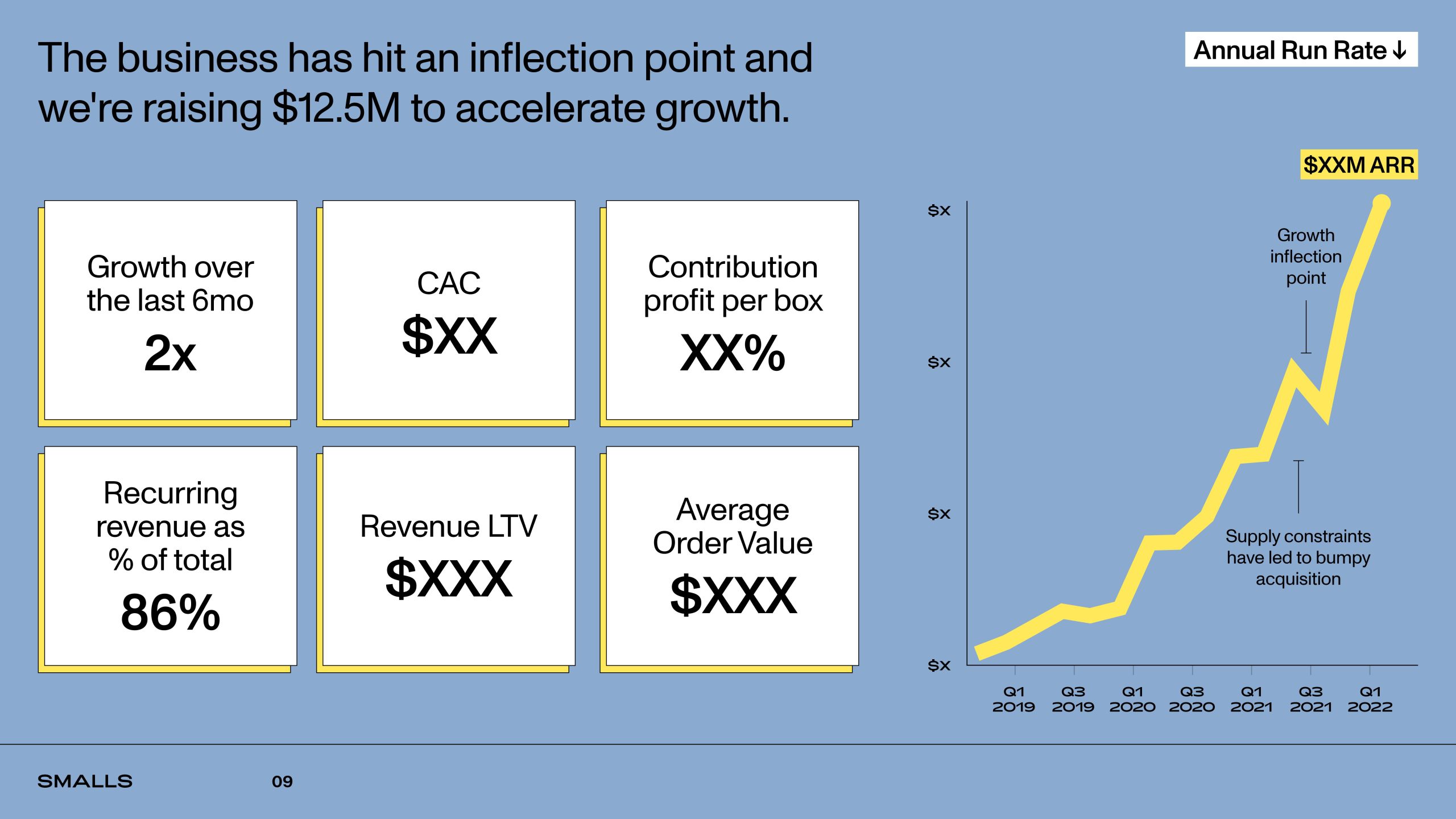

[Slide 9] A lot of the numbers are redacted, but there’s still a lot to learn here. Image Credits: Smalls

I love a good metrics slide, and while the company blocked out a lot of its actual numbers, what’s fascinating here is the growth chart on the right and which metrics the company cares about. Even without knowing the precise numbers, you can tell a lot about a company from what it considers its KPIs.

It’s great that 86% of revenue is recurring revenue, and doubling revenue over the past six months is incredibly encouraging. It’s obvious that the Smalls team has found a furmula (see what I did there?) for success. Tracking CAC, profit per box, LTV, AOV and ARR are the key metrics you’d expect from any subscription business, and in this case, the business is experiencing extreme growth.

It’s a little curious that it’s raising $12.5 million specifically (why not $12 million or $13 million or $15 million?), and with the benefit of hindsight, it raised $19 million in this round anyway. It’s not uncommon for companies to discover opportunities for more aggressive growth or bigger market expansions in the investment process, and it’s possible that’s why it took more funds.

Impressive top-of-funnel

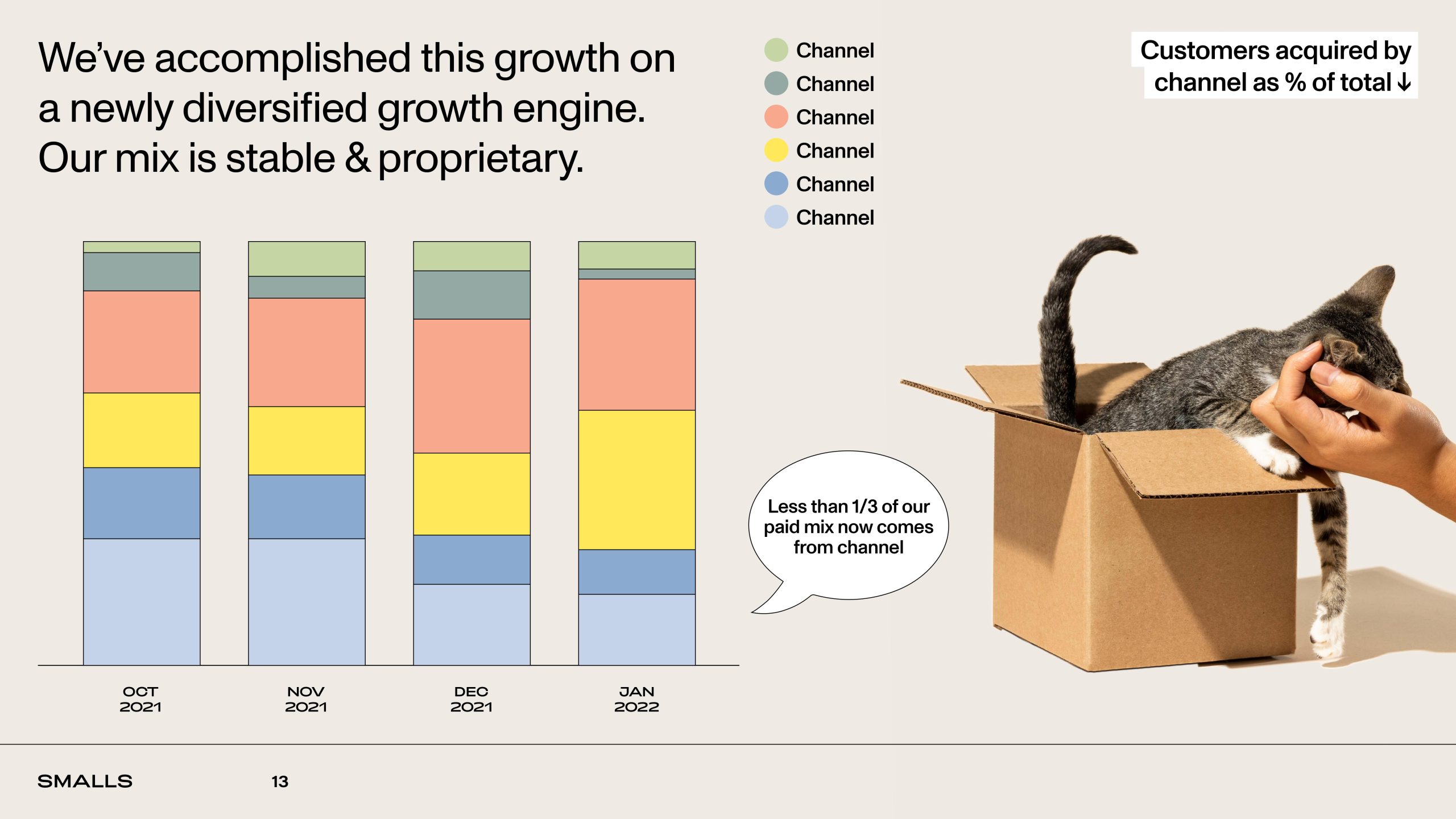

The company has diversified its acquisition channels, which is a great way of de-risking:

[Slide 15] Evolving channel mix. Image Credits: Smalls

That less than 33% of its acquisitions comes from a single channel is indicative of a business that hasn’t put all of its kittens in one basket. What this slide tells me is that Smalls has a robust and relatively sophisticated take on growth — exactly what an investor would want to see before pouring a giant chunky sachet of sauce-covered dollar bills into Smalls’ bowl.

In the rest of this teardown, we’ll take a look at three things Smalls could have improved or done differently, along with its full pitch deck!