.jpg)

A Critical New Drug Is Coming—Unless Agriculture Gets There First

Physicians have been eagerly anticipating olorofim, which represents a new class of fungal drug, technically termed a DHODH inhibitor. “New class” is important: It indicates a new molecular mechanism, one that fungi would not have experienced before. Olorofim has been in development for more than a decade and is currently in phase 2 trials; the FDA has given it a “breakthrough therapy” designation to fast-track it because it fills a critical unmet need.

But last summer, in email chatter leading up to that National Academies meeting, olorofim’s sponsors learned their drug was not the first DHODH inhibitor on track to be rolled out in the US. Ipflufenoquin, which works on the same molecular pathway, had just gained approval after making its way through a similar regulatory channel at the EPA. That sparked worry among the drug’s developers: If the agricultural version deployed first, olorofim’s effectiveness might be threatened before it could even debut. “Fungi have so many intracellular targets that are the same as in human cells that to find one that is druggable and doesn’t induce significant human toxicity is a real challenge,” says Emma Harvey, F2G’s global head of medical affairs. “We think we’ve done that. So now to find that agricultural fungicides are targeting the same enzyme—that’s a real concern for us.”

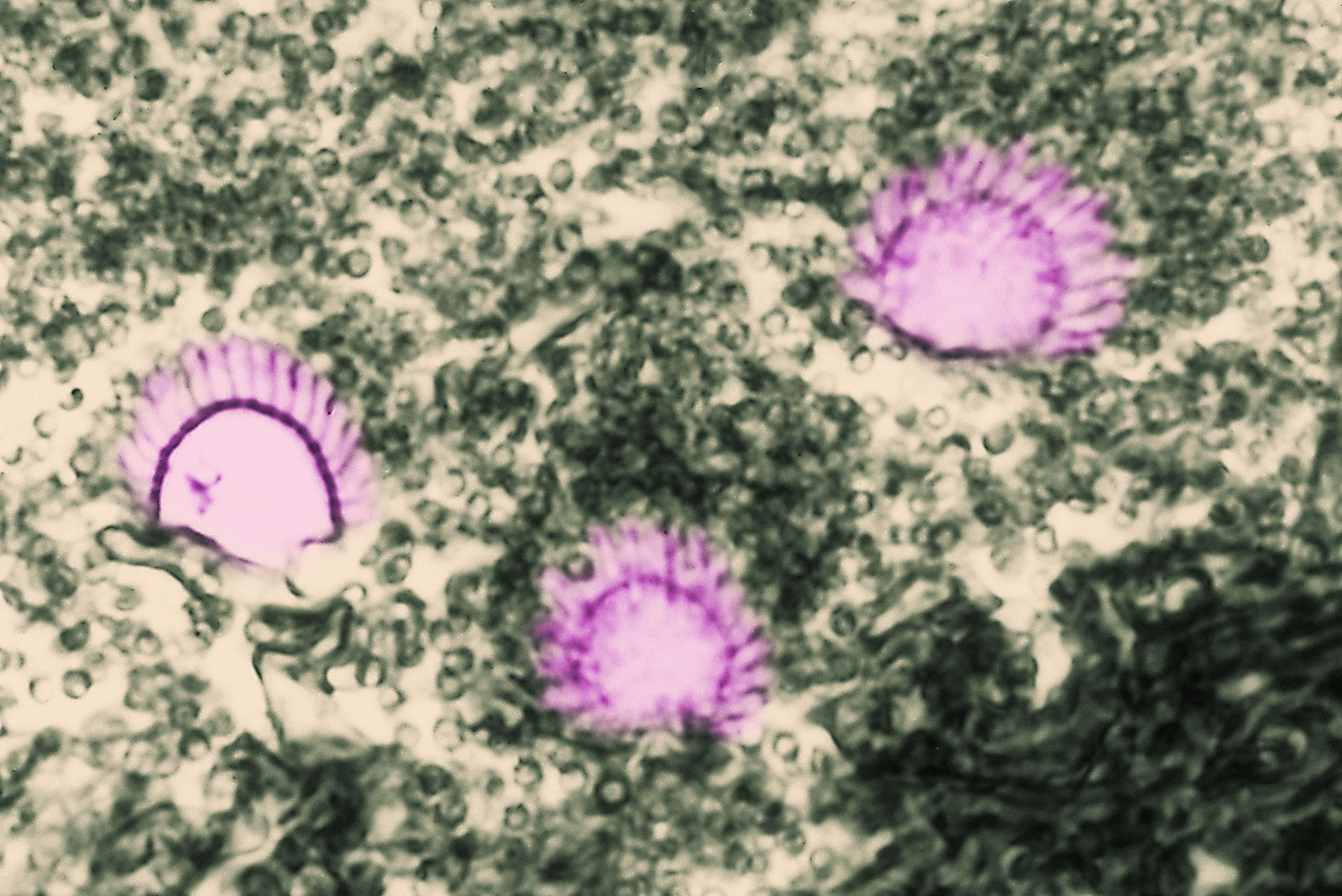

As much as humans need antifungal compounds, plants need them too. In fact, going purely by the numbers of organisms affected, plants might need them more. Eighty percent of all plant diseases are caused by fungi. The Irish potato famine of the 19th century, the American chestnut blight and Dutch elm disease epidemics of the 20th century, the worldwide switch from Gros Michel bananas to the modern Cavendish, the fact that the world’s coffee industry resides in South America though it began in South Asia—all of those were the result of fungal pandemics. And between pandemic waves, growers of all varieties of plants—wheat, cacao, pears, grapes, tomatoes—are engaged in a persistent low-level battle against fungal diseases.

“It’s been estimated that there would be 20 percent yield losses in crops all over the world without fungicides because of how damaging fungi are to plants,” says Marin Talbot Brewer, a plant pathologist and professor of mycology at the University of Georgia. “And it’s not just that they affect the amount of food that we have, but they can affect the quality of food as well because some produce mycotoxins.”

Viewed through that lens, the development of a new plant fungicide ought to be welcome. Ipflufenoquin’s manufacturer Nisso said in paperwork submitted to the EPA that the compound offered a “novel, undefined” method of killing, and thus might slow down plant fungi for a while.

Representatives of the manufacturer, a subsidiary of the Japanese firm Nippon Soda Co., declined an interview. “It is our corporate policy not to discuss our technology,” Shane Barney, Nisso America’s head of agrochemicals, told WIRED by email.

For more information on the compound, he pointed WIRED to the docket that the company submitted to the EPA when it filed for registration (the agency’s equivalent of approval) in 2020. Those public documents define how the fungicide should be applied, set the amounts of residues that can be left behind after application, and confirm the fungicide passed toxicity tests for other plants, pollinators, and birds. For human health, the documents confirm that the compound passed toxicity evaluations for work and home exposures and exposure via food and drinking water. The EPA assessed all this as adequate and registered ipflufenoquin in March 2022. California registered the compound at the same time. (WIRED was not able to ascertain whether growers are applying it yet.)