Andreessen Horowitz saw the future — but did the future leave it behind?

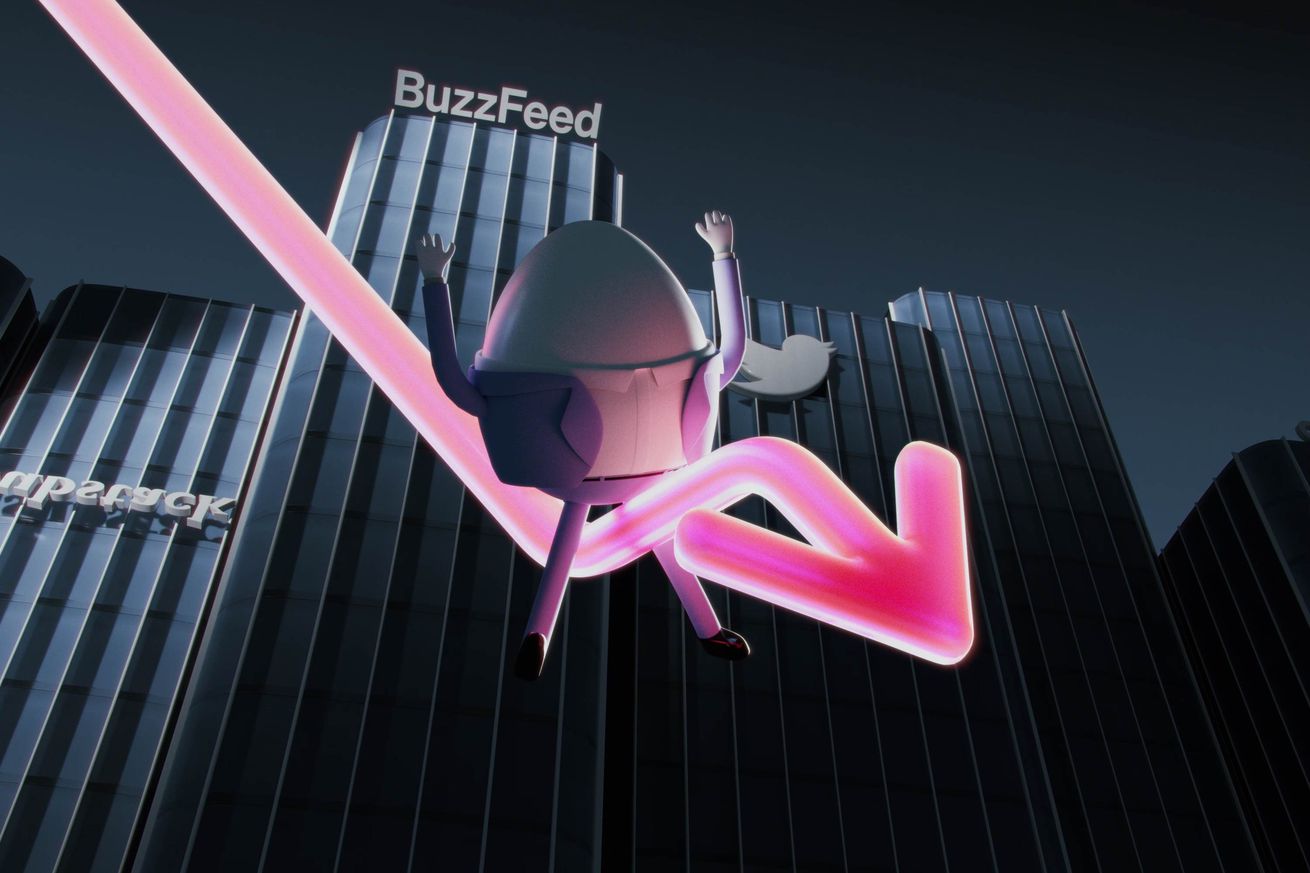

Before Clubhouse, Substack, and Elon Musk’s Twitter 2.0 began floundering, they were supposed to revolutionize media. They also have something else in common: they were all backed by venture capital firm Andreessen Horowitz (sometimes stylized as a16z) and represented a Silicon Valley attempt to circumvent the so-called mainstream media.

But despite the initial promise of each of these companies, they’ve turned out to be pandemic fads (Clubhouse), to be pulling in negative revenue (Substack), or to be burning merrily to the ground attempting to accommodate the whims of Elon Musk (Twitter).

Funnily enough, one of the things Marc Andreessen is famous for is something he wrote for a mainstream media outlet. In a 2011 Wall Street Journal op-ed titled “Why Software Is Eating the World,” he made a point that is, in retrospect, obviously true: “we are in the middle of a dramatic and broad technological and economic shift in which software companies are poised to take over large swathes of the economy.”

In the editorial, he chalks this up to the potential power of the smartphone and lower costs on the back end. He tut-tuts anyone questioning the valuations of the software startups. While there are examples in the op-ed that are convincing — Netflix killing Blockbuster, Amazon killing Borders — one of Andreessen’s primary examples is Groupon, in which a16z was an investor.

Hyping a startup isn’t something a VC can do alone

In 2010, Forbes called Groupon “the fastest growing company ever.” In 2011, its IPO was the biggest internet coming-out party since Google, raising $700 million at a valuation of nearly $13 billion. On the day of its IPO, Groupon’s share price closed above $26. Today, Groupon’s share price is around $4 after announcing a 1-for-20 reverse stock split in 2020. (That means one share today would have been the same as 20 at its IPO.) It had just 19 million active customers at the end of fiscal year 2022. At its peak in 2011, it reported having 83 million subscribers but no “reliable system to accurately identify the number of actual subscribers.” It turns out that the IPO pop was Groupon’s peak.

Groupon was prophetic, too. In venture capital, there are a few ways to make money. One is traditional and difficult: find and invest in promising businesses and then nurture them. Another way is to find a business, hype your investment, let its valuation balloon, and then offload it further down the line. a16z did the latter with Groupon, dumping its shares quickly for a modest profit of almost $14 million on its $40 million investment as soon as its lockup expired in June 2012. Had his venture fund, Andreessen Horowitz, held those shares to August 2012, the investment would have been underwater, VentureBeat reported at the time.

The investment happened just before the IPO. “Groupon would never have gotten this big without that late-stage money,” investor Bill Gurley — who Andreessen has called “my Newman,” in reference to the Seinfeld antagonist — told the Journal at the time. Still, Gurley said his decision to pass on Groupon was, in hindsight, a mistake: “The guys that backed Groupon early — even at today’s prices — they made lots of money.”

The thing about these two strategies for VC is that they both can turn a profit. That second one, though, works a little differently than the first. Regardless of whether the company succeeds, pumping its valuation before selling your shares can mean you will make money, even if the business itself doesn’t survive in the long term. But hyping a startup isn’t something a VC can do alone. He needs help. He needs the media.

In many ways, a16z created the playbook for the boom times in tech

Analyst and former a16z partner Benedict Evans has called the firm “a media company that monetizes through VC.” An operating partner at the firm, Margit Wennmachers, runs its media strategy; she encouraged that Wall Street Journal op-ed, according to Eric Newcomer, who writes a newsletter about venture capital. Andreessen also held cocktail parties for the anointed reporters — and cut off anyone who wrote anything critical.

In many ways, a16z created the playbook for the boom times in tech. During the era of fawning tech journalism and low interest rates, valuations of private companies exploded. Founders were “geniuses” and “rockstars”; it was easy to raise and easy to spend. There were herds of “unicorns,” companies that are valued at more than $1 billion. (This is to say nothing of “decacorns.”) Startups stopped running lean and instead got fat, attempting to outspend their competition.

This strategy is now at least two vibe shifts behind.

The first occurred after the blockbuster Wall Street Journal report on Theranos, which suggested that there was deception afoot. (Elizabeth Holmes was later found guilty of fraud.) The exposé — combined with the fact that the tech industry was bigger and more influential than ever — led many news organizations to decide that more critical coverage was needed.

“We tend to be pro-megalomania.”

When Andreessen was the subject of a Time cover story in 1996, the tech industry was full of weird, nerdy underdogs. (Many in the industry still imagine this is who they are.) It was covered primarily by an enthusiast press of geeks. In 2015, Andreessen was a vocal defender of Holmes. Though he hadn’t invested in Theranos, his wife had written a piece for T Magazine’s The Greats issue about Holmes, positioning her as “doing more than running one of the world’s most successful start-ups — she may be starting a movement to change the health care paradigm as we know it.” The piece was published online on October 12th and in print on October 25th; in between those two dates, the Journal exposé went live.

One of the ways that Andreessen Horowitz marketed itself as distinct from its competitors was its founder-centric approach, which, during the go-go era of the 2010s, was in high style. It’s probably part of the reason that Andreessen defended Holmes — he wanted to make it clear to founders that he was on their side no matter what. “We tend to be pro-megalomania,” Andreessen said in 2009.

More aggressive reporting on tech jeopardized the model of hyping a business and then selling after an inflated valuation. It’s no surprise, then, that Andreessen turned on the media. It probably didn’t help that The Wall Street Journal suggested in 2016 that a16z was all hat and no cattle — not really an elite firm if you looked at its returns, which had merely doubled its investment capital. The article contrasted a16z’s performance with that of Bill Gurley’s Benchmark, which “has multiplied investors’ money 11 times net of fees in its 2011 fund, according to a person familiar with its performance.”

Still, a 2014 Andreessen article about the news media is perceptive. Unlike most techies, Andreessen’s aware that the “view from nowhere” is a recent artifact, born from media consolidation. He knew how important distribution was. His list of possible business models was among those many publications experimented with. Andreessen and a16z even made a few media investments. They largely failed.

Perhaps the most public failure was Future, a16z’s in-house media arm devoted to industry analysis and op-eds. In 2021, it launched with much fanfare: a way to go direct to audiences without having to deal with those irritating journalists! “Unapologetically pro-tech”!

The main problem with Future was that it was boring, and accordingly, its audience fell off. Future quit publishing in October 2022, a year and a half after it launched. Shortly after Insider requested comment from Andreessen about the end of Future, he wrote a long tweet thread instead, noting that a16z employed almost 500 people and saying that he was focused on evaluating and closing new investments when he wasn’t working “extensively” with portfolio companies.

Insider was one of Andreessen’s personal investments in media; it sold to Axel Springer for around $450 million. He didn’t mention that to the audience he was wooing on Twitter.

The other vibe shift that would seriously affect a16z’s strategy, of course, was the Fed.

When a16z was founded in 2009, the Fed’s interest rate was near zero, where it mostly remained until 2022. A series of rate hikes beginning last year means that borrowing money is now more expensive than it has been at any point in the history of Andreessen Horowitz.

“They really embody the cowboy capitalist ethos.”

And while VCs look powerful to startup founders, they are actually middlemen. Most VC firms raise capital from sources such as pension funds, family offices, and endowments. That money was easy to raise when interest rates were low. Andreessen Horowitz now has 27 funds under management and has raised $32.4 billion, according to Crunchbase.

The go-go era of easy money helped shape a16z’s strategy. In 2009, it bought almost 2 percent of Skype for $50 million and more than tripled its money when Microsoft bought the video service less than two years later, according to Fortune. In 2010, partner Ben Horowitz published an article called “The Case for the Fat Startup.” Horowitz encouraged startups to splash out to build. “You cannot save your way to winning the market,” he wrote. a16z even had a services team to help its portfolio companies with marketing, business development, finance, and recruiting, Forbes reported.

Because it was easy to raise capital, the goal was to prioritize growth and worry about the cash burn later. “I admire that they take big swings; they really embody the cowboy capitalist ethos,” a partner at a rival VC firm said of a16z to Fortune last year.

One thing that a16z was known for was the ballooning valuations of its portfolio companies. Take Clubhouse, the then-buzzy startup that raised $100 million, led by a16z, at a $1 billion post-money valuation in January 2021. Three months later, it raised again at a $4 billion valuation in a round also led by a16z.

“Andreessen Horowitz will always be the OG when it comes to doling out speculative startup valuations,” Newcomer wrote in May 2022. In December 2022, Clubhouse downloads were down 84 percent year over year, according to Sensor Tower data. By March 2023, about 20 leaders at the company had left. Last week, the company fired half its workforce.

There are a limited number of companies that can scale as massively as venture capital requires

In 2019, Andreessen Horowitz registered its entire firm as an investment adviser. (SoftBank, another megafund, also did this.) Venture capital companies have a tradeoff: they are less regulated than investment advisors but must invest the majority of their funds as new stakes in private companies. By taking this step, a16z could devote more money to crypto, which also boomed in the low interest rate environment.

Crypto is perhaps the purest hype-driven investment possible — relying almost exclusively on investor sentiment. During its various bull runs, the details of any given project weren’t as important as how people felt about it, and less detailed projects were more valuable, according to Julian Wadsworth, a cultural critic who also goes by Lil Internet. Andreessen Horowitz was squarely in the middle of all of this.

There’s Coinbase, in which a16z invested eight times before its direct listing. When newsletter writer and former ConsenSys employee Fais Khan looked at the returns on some of the VC-backed coins listed on Coinbase, he noticed a pattern: a steep decline in value. That doesn’t look good.

A lot of money flowed into VC during the 2010s because it was hard to make a return elsewhere — one of the joys of the low interest rate environment. But there are a limited number of companies that can scale as massively as venture capital requires. That meant valuations skyrocketed as VCs competed for companies to invest in. It also meant that some businesses that weren’t compatible with the level of returns venture capital expected got funding anyway because all that money had to go somewhere.

As investors competed for companies, firms relaxed their due diligence

One of the most useful things about Elizabeth Holmes’ trial for fraud was the amount of time the defense spent reaming Theranos investors for failures of due diligence. Her investors didn’t want to offend her lest they be shut out of the round. This didn’t just happen at Theranos, and it didn’t stop after Theranos, either. (See also: WeWork.) As investors competed for companies, firms relaxed their due diligence, especially in crypto. Some didn’t do it at all.

In 2009, a16z made eight investments, according to Crunchbase. In the first quarter of 2023 alone, the firm made 40 — which is down from the all-time peak of 68 in the last quarter of 2021 and first quarter of 2022. Sure, a16z became a behemoth, but as it made so many investments so quickly, it’s reasonable to wonder how much time was spent on due diligence for each of them.

In 2022, as the Fed raised rates, some VC firms sliced valuations of their portfolio companies by as much as 95 percent. There are probably still more markdowns coming. VC fundraising slowed in 2022, a trend that continued in 2023. Exits slowed, too.

Substack got caught in the middle of this. It was using the “fat startup” model to entice established writers onto its newsletter platform by offering some of them a guaranteed minimum income. In 2021, the year of negative revenue, it paid out more to writers than it took in on subscription fees.

The conditions for investing now are very different than they’ve been for most of the firm’s history

This kind of spending might have made sense at any point during the 2010s when companies such as Uber and Lyft spent freely to acquire new customers — effectively subsidizing rides in an effort to build market share. Sure, there were losses, but it was easy to raise more capital. But Substack’s timing was bad. It spent down $25 million of the $65 million it raised in 2021 alone — and couldn’t raise in 2022 when venture funding dried up.

Adding to the uncertainty, Silicon Valley Bank, one of the central institutions of the startup economy, was toppled by a bank run. Edgy VCs advised their companies to pull funds, and it spiraled into collapse. That further chilled funding for startups. There is also some uncertainty around stakes in VC funds including a16z that were owned by SVB Capital, which is now up for sale.

Andreessen Horowitz hasn’t been caught entirely flat-footed. Last year, the firm began moving into private wealth management because “money comes in the door, it’s generally slow to exit,” according to Bloomberg. In addition, Horowitz is actively wooing investors in Saudi Arabia, having stopped there twice in less than six months, the Financial Times reports.

Still, the conditions for investing now are very different than they’ve been for most of the firm’s history, and it’s not clear that a16z is prepared for the new world. For instance, The Wall Street Journal reported in October that the a16z crypto fund was down “around 40 percent” in the first half of 2022. It’s not hard to see why: crypto is currently in the toilet.

But a16z chose to invest in Adam Neumann’s new startup last year despite the founder’s highly public attempt to extract as much personal wealth as possible from WeWork. Maybe this is virtue signaling: it wrote its largest individual check ever to Neumann, perhaps as an advertisement for a16z’s commitment to wild founders. a16z also chose to invest in Elon Musk’s deal to take Twitter private and run it into the ground.

Those investments make me wonder if the firm is stuck in the past, still trying to thumb its nose at its perceived enemies. Certainly, the investing playbook of the 2010s — the one it arguably invented — is outdated.

The New Yorker once hailed Marc Andreessen as “tomorrow’s advance man.” The question now is whether his vision of the future might be history.