5 Best Exchanges to Buy Bitcoin or ETH in the USA [2023]

As Bitcoin and other cryptocurrencies continue to gain popularity in the USA in 2023, choosing the best cryptocurrency exchange to buy Bitcoin or ETH or any other Cryptocurrency can be a daunting task. To help you make the right decision, we’ve compiled a list of the top 5 Cryptocurrency Exchanges to buy Bitcoin or ETH in the USA based on their key features, pros, cons, and price, and provided the relevant links. We will also provide a detailed explanation of each platform to give you a better understanding of their offerings.

Best Exchanges to Buy Bitcoin or Other Cryptocurrency in the USA

I have listed down more than 5 best Cryptocurrency Exchanges in the industry to buy Bitcoin in the USA. They all have their pros and cons, so you can choose which one works for you and go ahead with that.

| Exchange Name | Rating | Fees |

|---|---|---|

| 1. Binance | 4.7 | 0.1% (maker/taker), lower with BNB |

| 2. Coinbase | 4.5 | 0.5% (spread) + transaction fee |

| 3. Kraken | 4.4 | 0.16% (maker) – 0.26% (taker) |

| 4. Bitfinex | 4.3 | 0.1% (maker) – 0.2% (taker) |

| 5. Gemini | 4.3 | 0.1% (maker) – 0.35% (taker) |

| 6. Huobi Global | 4.2 | 0.2% (maker/taker), lower with HT |

| 7. Bittrex | 4.1 | 0.25% (maker/taker) |

| 8. KuCoin | 4.1 | 0.1% (maker/taker), lower with KCS |

| 9. OKEx | 4.1 | 0.1% (maker) – 0.15% (taker), lower with OKB |

| 10. Bitstamp | 4.0 | 0.1% – 0.5% (depending on volume) |

| 11. Poloniex | 3.9 | 0.125% (maker) – 0.25% (taker) |

| 12. Coinmama | 3.9 | 5.9% (spread) + transaction fee |

| 13. CEX.IO | 3.8 | 0.16% (maker) – 0.25% (taker) |

| 14. Bitso | 3.8 | 0.1% (maker) – 0.65% (taker) |

| 15. Liquid | 3.7 | 0% (maker) – 0.3% (taker) |

| 16. Bithumb | 3.7 | 0.15% (maker/taker) |

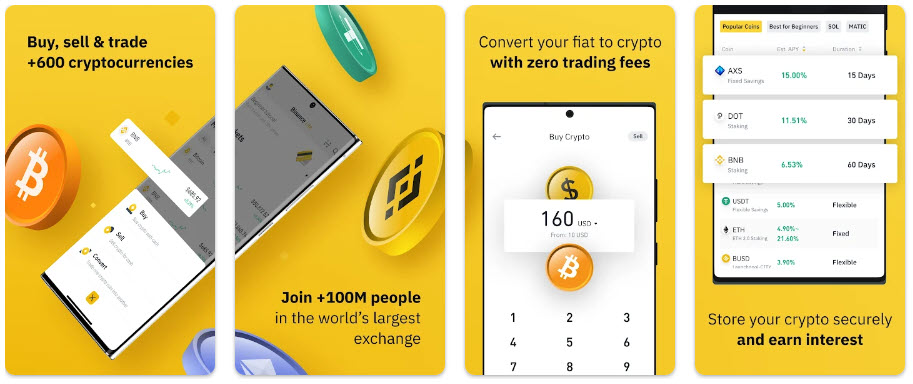

1. Binance.US

Binance.US is the American branch of Binance, the world’s largest cryptocurrency exchange. This platform offers a wide range of cryptocurrencies and high liquidity, making it a popular choice for traders in the US. The interface is user-friendly, but advanced trading features can be complex for beginners. Binance.US has competitive fees and responsive customer support, but it is not available in all US states, and certain altcoins lack fiat trading pairs.

Binance is not just an app but the largest cryptocurrency exchange in the world when it comes to daily trading volume in cryptocurrencies. The company was founded in 2017 and the company is registered in the Cayman Islands.

With Binance, you can buy, trade, and hold 600+ cryptocurrencies in a single app. Even though the company has come under scrutiny for a couple of controversies related to money in the last couple of years, Binance still stands steady as a strong player in the cryptocurrency sector.

In addition to all of that, they have two different cryptocurrencies of their own. They are Binance Coin (launched in June 2017) and Binance Smart Coin (founded in September 2020). Also, BSC supports smart contracts and Ethereum virtual machines.

- Key Features: Wide range of cryptocurrencies, high liquidity, advanced trading features, and staking rewards.

- Pros: Competitive fees, user-friendly interface, extensive trading options, and responsive customer support.

- Cons: Limited availability in some US states, no fiat trading pairs for certain altcoins, and complex interface for beginners.

- Price: Trading fees start from 0.1% and are reduced further based on trading volume or BNB holdings.

Website | Android App | iOS App

Steps to buying Bitcoin in the US with Binance US:

- Sign up for an account on the Binance US website and complete the necessary verification process.

- Once you have logged in to your Binance US account, click on the “Buy Crypto” tab on the top menu and select “Credit/Debit Card” as your payment method.

- Choose “Bitcoin” as the cryptocurrency you wish to purchase and enter the amount of Bitcoin you want to buy.

- Fill in your credit or debit card information, including the card number, expiration date, and security code.

- Confirm the details of your purchase and click on the “Buy BTC” button to complete the transaction.

- Your Bitcoin should now be available in your Binance US account.

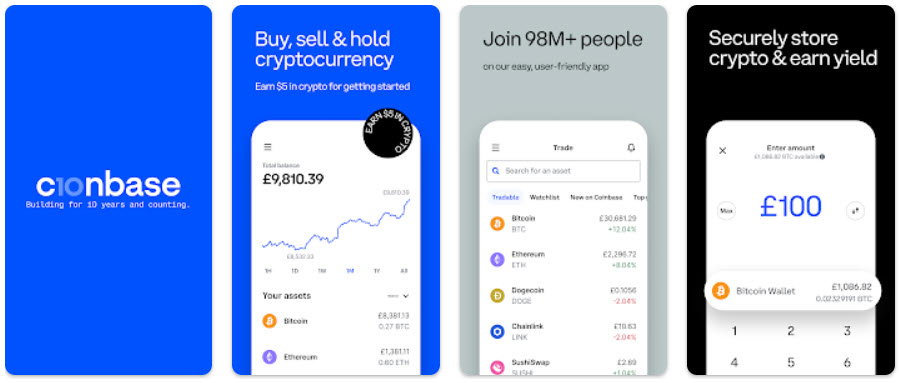

2. Coinbase

Coinbase is another cryptocurrency exchange that operates based in the United States. Even though it’s based in the US, they have no office space and are entirely remote-operated company. When it comes to trading volume, it’s the largest in the United States while Binance holds that position in the entire globe.

This company was founded in 2012 by Fred Ehrsam and Brian Armstrong. Coinbase offers products for institutional and retail investors. They have so many products and these are some of them.

Coinbase provides a secure wallet for storing your assets and employs strong security measures such as two-factor authentication. One downside is that Coinbase’s fees are higher than some competitors, and the platform has limited payment methods.

- Coinbase app -> trading cryptocurrency

- Coinbase Pro -> asset trading platform

- Coinbase Wallet -> access crypto apps using dapp browser

- Coinbase NFT -> buy/sell NFT products.

- Coinbase Prime -> trading platform for institutional users.

- Coinbase Card -> Visa card to spend cryptocurrency

- Coinbase Commerce -> payment service

- Coinbase Earn -> learning platform that rewards for watching videos and learning.

Coinbase is available in 32 countries and wallet is available in 190 countries. Coinbase holds about $90 billion of $782 billion total worth of cryptocurrency assets on its platform. As part of the SEC filing, coinbase has 43 million verified users and also 7000 institutions, and 115,000 partners from 100 countries.

Coinbase is a well-established platform that has been around since 2012. It offers a user-friendly interface that makes it easy for both beginners and experienced users to buy and sell Bitcoin and other cryptocurrencies.

- Key Features: User-friendly interface, secure wallets, multiple cryptocurrencies supported, two-factor authentication, and recurring buys.

- Pros: Easy to use, insured deposits, strong security measures, and excellent customer support.

- Cons: Higher fees compared to some competitors, limited payment methods, and occasional account freezes.

- Price: Variable fees based on transaction type (e.g., 1.49% for bank transfers, 3.99% for debit/credit card transactions).

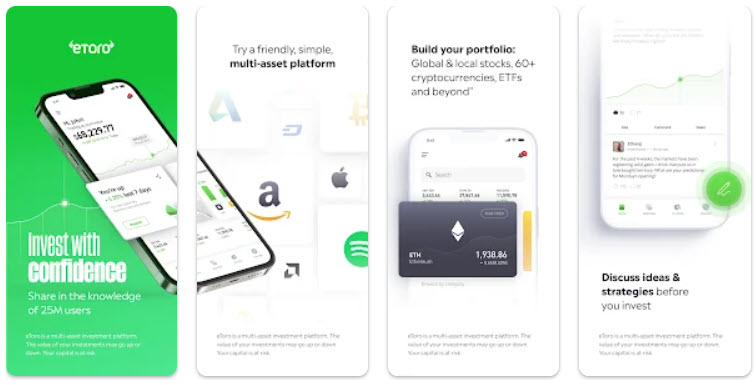

3. eToro

eToro is a traditional trading and investment company and one of the best exchanges to buy Bitcoin, ETH, or any other Cryptocurrency in the USA. It has been around for a long time and the company is valued at around $8.8 billion. eToro is based in Israel and it has offices in the UK, the US, Australia, and other parts of the world.

eToro started adding cryptocurrencies to its investment platform back in 2014. It has significantly grown in the last 8 years and as of March 2022, eToro has about 27 million users from all around the world. It is known for its copy trading feature, which enables users to follow and mimic the trades of experienced traders. The platform is user-friendly and suitable for beginners but offers a limited range of cryptocurrencies compared to other platforms. eToro charges spread-based fees, which can be high for certain transactions. Additionally, withdrawals are only available in fiat currency.

- Key Features: Social trading platform, copy trading, user-friendly interface, and multiple asset classes.

- Pros: Suitable for beginners, social trading features, and regulated platform.

- Cons: Limited cryptocurrency offerings, high fees for certain transactions, and withdrawals only in fiat currency.

- Price: Spread-based fees start from 0.75% for Bitcoin and vary for other cryptocurrencies.

Website | Android App | iOS App

4. Gemini

Gemini is a US-based cryptocurrency exchange founded by the Winklevoss twins in 2014. The platform is known for its strict compliance with regulations, making it a trustworthy choice for those concerned about security. Gemini offers an advanced trading platform and supports multiple cryptocurrencies, but its liquidity is lower compared to some competitors. Fees are competitive, but the platform has limited availability outside the US.

- Key Features: Trustworthy and regulated, multiple cryptocurrencies, advanced trading platform, and institutional-grade security.

- Pros: Strong security measures, user-friendly interface, competitive fees, and insured deposits.

- Cons: Limited availability outside the US, lower liquidity compared to some competitors, and fewer altcoins.

- Price: 0.5% convenience fee plus transaction fees ranging from $0.99 to 1.49% depending on the amount.

- Website | Android App | iOS App

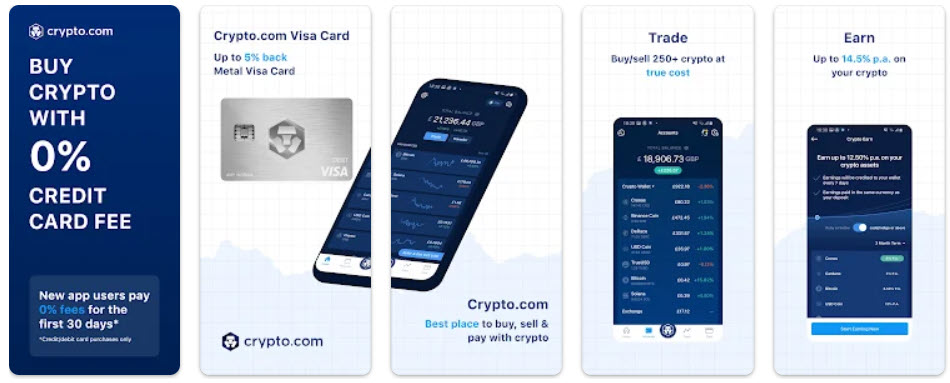

5. Crypto.com

Crypto.com is another popular cryptocurrency exchange which is based in Singapore. It has more than 50 million customers and is primarily focused on the eastern part of the world. With 4000 employees placed across the world, crypto.com has secured some serious spots for marketing in the western part of the world.

They have their own cryptocurrency called the Cronos. The company was initially founded by Bobby Bao, Gary Or, Kris Marszalek, and Rafael Melo in 2016.

Crypto.com has been on the bad end of a hack in the last year losing about 15 million worth of Ether. There was an extreme panic but the company managed to salvage the damage by issuing a statement regarding the state of the attack.

- Key Features: Mobile-first platform, Crypto.com Visa card, multiple cryptocurrencies, and staking rewards.

- Pros: Wide range of features, competitive fees, and user-friendly mobile app.

- Cons: Limited desktop interface and some geographical restrictions.

- Price: Trading fees start from 0.1% and decrease based on trading volume and CRO token holdings.

Website | Android App | iOS App

6. Kraken

Kraken is a well-known cryptocurrency exchange that has been operating since 2011. It offers a wide range of cryptocurrencies and high liquidity, making it an ideal platform for advanced traders. The interface can be complex for beginners, but experienced users appreciate the advanced trading features, including margin and futures trading. Kraken’s fees are among the lowest in the industry, but the account verification process can be slow.

- Key Features: High liquidity, extensive range of cryptocurrencies, margin trading, and futures trading.

- Pros: Low fees, secure platform, high trading volume, and excellent customer support.

- Cons: Complex interface for beginners and slow account verification process.

- Price: Fees range from 0.16% to 0.26% depending on the trading volume.

Website | Android App | iOS App

7. Bitstamp

Bitstamp is a European-based cryptocurrency exchange that has been operating since 2011. It offers high liquidity, competitive fees, and advanced trading tools, making it suitable for experienced traders. The interface is simple, but it might not be ideal for beginners due to limited educational resources. Bitstamp has strong security measures in place and provides excellent customer support.

- Key Features: Simple interface, high liquidity, multiple cryptocurrencies, and advanced trading tools.

- Pros: Competitive fees, strong security measures, and excellent customer support.

- Cons: Limited payment methods and not ideal for beginners.

- Price: Trading fees start from 0.5% and decrease based on trading volume.

8. CEX.IO

CEX.IO is a UK-based cryptocurrency exchange that provides a user-friendly interface for buying and selling Bitcoin and other cryptocurrencies. It supports multiple payment methods, making it convenient for users. However, the platform has a limited range of cryptocurrencies and higher fees compared to competitors. CEX.IO also offers an instant buy feature and staking options for supported cryptocurrencies.

- Key Features: Multiple payment methods, user-friendly interface, instant buy feature, and staking options.

- Pros: Easy to use, supports multiple cryptocurrencies, and offers a variety of payment options.

- Cons: Higher fees compared to competitors and limited range of cryptocurrencies.

- Price: Trading fees start from 0.25% and decrease based on trading volume.

9. Coinmama

Coinmama is a straightforward platform for buying Bitcoin and other cryptocurrencies using various payment methods, including credit/debit cards and bank transfers. It is known for its fast transactions and high purchase limits, making it suitable for users who need to buy large amounts of cryptocurrency. However, Coinmama has high fees compared to competitors and requires an external wallet for storage.

- Key Features: Quick and easy purchases, multiple payment methods, and high spending limits.

- Pros: User-friendly platform, fast transactions, and high purchase limits.

- Cons: High fees and no integrated wallet (requires an external wallet).

- Price: Transaction fees start from 5.9% plus an additional 5% for credit/debit card transactions.

10. Uphold

Uphold is a multi-asset platform that allows users to buy and sell Bitcoin and other cryptocurrencies, along with other asset classes like stocks and precious metals. The platform has a user-friendly interface and supports multiple payment methods, making it convenient for users. Uphold offers instant trades but has a limited range of cryptocurrencies and higher fees compared to competitors. Additionally, users have reported slow customer support response times.

- Key Features: Multi-asset platform, user-friendly interface, instant trades, and supports multiple payment methods.

- Pros: Easy to use, supports various asset classes, and offers instant trades.

- Cons: Limited range of cryptocurrencies, higher fees compared to competitors, and slow customer support.

- Price: Trading fees start from 0.65% and vary based on the asset type.

11. Swan Bitcoin

Swan Bitcoin is a platform focused on long-term Bitcoin investing through dollar-cost averaging. It allows users to set up automatic recurring purchases, making it easy for them to accumulate Bitcoin over time. Swan Bitcoin offers low fees and excellent educational content but is limited to Bitcoin only and does not provide trading options.

- Key Features: Dollar-cost averaging, automatic recurring purchases, user-friendly interface, and educational resources.

- Pros: Focus on long-term investing, low fees, and excellent educational content.

- Cons: Limited to Bitcoin only and no trading options.

- Price: Fees range from 0.99% to 2.29% depending on the plan chosen.

12. River Financial

River Financial is a Bitcoin-only platform that focuses on providing a user-friendly and secure environment for Bitcoin enthusiasts. It offers deep liquidity, dollar-cost averaging options, and strong security measures. However, River Financial is limited to Bitcoin only and does not provide a mobile app for on-the-go trading.

- Key Features: Bitcoin-only platform, user-friendly interface, dollar-cost averaging, and deep liquidity.

- Pros: Focus on Bitcoin, strong security measures, and easy-to-use interface.

- Cons: Limited to Bitcoin only and no mobile app.

- Price: Trading fees start at 1% and decrease with volume.

13. Paxful

Paxful is a peer-to-peer platform that connects buyers and sellers directly, allowing users to negotiate their terms and choose from a wide variety of payment methods. It is globally available and offers an escrow service for secure transactions. While there are no fees for buyers, sellers pay a 1% fee on completed trades. Users should be cautious and aware of potential scams, as exchange rates can vary significantly between offers.

- Key Features: Peer-to-peer platform, multiple payment methods, user-generated offers, and escrow service.

- Pros: Wide variety of payment options, global availability, and no fees for buyers.

- Cons: Fees for sellers, the potential for scams, and varying exchange rates.

- Price: No fees for buyers, but sellers pay a 1% fee on completed trades.

Website | Android App | iOS App

14. Cash App

Cash App, developed by Square Inc., is a mobile payment app that allows users to buy and sell Bitcoin seamlessly alongside other payment features. The platform is user-friendly and supports quick transactions, making it convenient for those who want to buy and sell Bitcoin on the go. Cash App is limited to Bitcoin only and imposes withdrawal limits. There are no fees for buying or selling Bitcoin, but fees apply for instant withdrawals.

- Key Features: Mobile payment app, Bitcoin buying and selling, user-friendly interface, and instant transfers.

- Pros: Easy to use, quick transactions, and integrates with other Cash App features.

- Cons: Limited to Bitcoin only, withdrawal limits, and fees for instant withdrawals.

- Price: No fees for buying or selling Bitcoin but fees for instant withdrawals.

Website | Android App | iOS App

15. Changelly

Changelly is a platform that allows users to instantly swap cryptocurrencies without registration.

The platform offers a user-friendly interface and supports a wide range of cryptocurrencies. Changelly is known for its fast and easy transactions but has higher fees compared to other exchanges. Users must have an external wallet to store their assets, as Changelly does not provide an integrated wallet.

- Key Features: Instant cryptocurrency swaps, user-friendly interface, and multiple cryptocurrencies.

- Pros: Fast and easy transactions, wide range of cryptocurrencies, and no registration required.

- Cons: Higher fees and no integrated wallet (requires an external wallet).

- Price: 0.25% flat fee for cryptocurrency swaps.

Website | Android App | iOS App

16. Bitso

Bitso is a Latin American-based cryptocurrency exchange that also operates in the USA. The platform offers a user-friendly interface, multiple cryptocurrencies, and low fees. Bitso is easy to use, but it has limited payment methods and slow customer support. The platform also supports cross-border transactions, making it convenient for international users.

- Key Features: Multiple cryptocurrencies, user-friendly interface, mobile app, and cross-border transactions.

- Pros: Easy to use, low fees, and supports various cryptocurrencies.

- Cons: Limited payment methods and slow customer support.

- Price: Trading fees start from 0.1% and decrease based on trading volume.

17. BitFlyer

BitFlyer is a Japanese-based cryptocurrency exchange that operates in the USA. The platform offers multiple cryptocurrencies, a user-friendly interface, and advanced trading options. BitFlyer is a regulated platform with high liquidity and competitive fees. However, the platform has a limited range of cryptocurrencies and a slow account verification process.

- Key Features: Japanese-based platform, multiple cryptocurrencies, user-friendly interface, and advanced trading options.

- Pros: Regulated platform, high liquidity, and competitive fees.

- Cons: Limited range of cryptocurrencies and slow account verification process.

- Price: Trading fees starting from 0.1% and decreasing based on trading volume.

- Website | Android App | iOS App

18. BlockFi

BlockFi is a platform that allows users to earn interest on their cryptocurrency holdings, including Bitcoin. The platform is user-friendly and offers competitive interest rates. However, BlockFi has limited trading options and charges withdrawal fees depending on the cryptocurrency. The platform also provides cryptocurrency-backed loans, enabling users to access liquidity without selling their assets.

- Key Features: Interest-earning accounts, cryptocurrency-backed loans, user-friendly interface, and multiple cryptocurrencies.

- Pros: Earn interest on cryptocurrency holdings, competitive rates, and easy to use.

- Cons: Limited trading options and withdrawal fees.

- Price: No trading fees, but withdrawal fees apply depending on the cryptocurrency.

- Website | Android App | iOS App

Steps to follow to Buy Bitcoin in the USA

If you’re considering buying Bitcoin in the USA, it’s essential to follow certain steps to ensure a secure and successful purchase. This guide will walk you through the necessary steps to prepare for buying Bitcoin in the USA.

Step 1: Research and Understand Bitcoin Before investing in Bitcoin, take the time to learn about the underlying technology, its history, and its potential use cases. This will help you make informed decisions and better understand the risks and rewards associated with investing in cryptocurrencies.

Step 2: Assess Your Risk Tolerance As with any investment, it’s important to assess your risk tolerance. Cryptocurrency markets are known for their volatility, which can lead to significant gains or losses. Determine how much you’re willing to risk and invest only what you can afford to lose.

Step 3: Choose a Secure Wallet A cryptocurrency wallet is essential for storing your Bitcoin securely. There are various types of wallets, including hardware, software, and mobile wallets. Research the pros and cons of each type and choose a wallet that best suits your needs and security preferences.

Step 4: Select a Reputable Exchange or Platform There are numerous platforms and exchanges available for buying Bitcoin in the USA. Research the available options and choose a reputable exchange with a strong track record of security, user-friendliness, and regulatory compliance. Some popular options include Coinbase, Kraken, and Gemini.

Step 5: Set Up an Account and Verify Your Identity Most exchanges require you to create an account and verify your identity before you can buy Bitcoin. This process typically involves providing personal information, such as your name, address, and a form of identification like a driver’s license or passport. Verification times can vary, so be prepared for this step to take some time.

Step 6: Secure Your Account Once your account is set up, enable two-factor authentication (2FA) to add an extra layer of security. This requires you to enter a code from an authenticator app or a text message in addition to your password when logging in.

Step 7: Link Your Bank Account or Credit/Debit Card To purchase Bitcoin, you’ll need to link a payment method to your account. This could be a bank account or a credit/debit card. Keep in mind that fees and processing times may vary depending on the payment method you choose.

Step 8: Learn about Fees and Charges Before buying Bitcoin, familiarize yourself with the fees and charges associated with purchasing and trading cryptocurrencies on your chosen platform. These fees can vary significantly and may include trading fees, deposit fees, and withdrawal fees.

Step 9: Make Your Purchase Once your account is set up, verified, and secure, you can proceed to buy Bitcoin. Choose the amount you’d like to purchase, review the fees and total cost, and confirm your transaction.

Step 10: Safely Store Your Bitcoin After purchasing Bitcoin, transfer your funds from the exchange to your secure wallet to minimize the risk of hacks or theft. Ensure you have a backup of your wallet’s private keys or recovery phrases in case of loss or damage.

FAQs on Buying Bitcoin

Bitcoin is a decentralized digital currency that allows for peer-to-peer transactions without the need for intermediaries such as banks or other financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto.

To store your Bitcoin, you’ll need a cryptocurrency wallet. Wallets come in various forms, such as hardware wallets, software wallets, and mobile wallets. They store your private keys, which are necessary to access and manage your Bitcoin holdings.

Investing in Bitcoin and other cryptocurrencies carries risks, as the market is known for its volatility. It’s essential to do thorough research, assess your risk tolerance, and invest only what you can afford to lose. Additionally, ensure that you use secure wallets and reputable exchanges to minimize security risks.

When choosing a Bitcoin exchange, consider factors such as security, fees, user-friendliness, regulatory compliance, and customer support. Popular exchanges in the USA include Coinbase, Kraken, and Gemini. Be sure to read reviews and do your research before making a decision.

Yes, many cryptocurrency exchanges allow you to buy Bitcoin using a credit card or debit card. However, fees and processing times may vary depending on the exchange and the payment method used.

Yes, it is legal to buy, sell, and hold Bitcoin in the USA. However, cryptocurrency regulations can vary from state to state, and some states may have specific rules or restrictions.

Cryptocurrency exchanges serve as intermediaries between buyers and sellers of digital assets. They provide a platform for users to trade cryptocurrencies against each other or against fiat currencies like the US dollar, Euro, or Japanese yen. Some exchanges also offer additional features such as margin trading, futures contracts, and staking services.