$4 Billion Center Set to Speed Chip Progress for Phones, Cars, and Everything Else - CNET

During the worst days of the pandemic, a chip shortage may have stopped you from buying a Ford F-150 or Sony PlayStation. Now some of the $53 billion in federal funds to try to ease the problem could help boost a new chip manufacturing research center in Silicon Valley.

Vice President Kamala Harris plans to visit Applied Materials on Monday as the chip manufacturing equipment supplier details a $4 billion investment center in California’s high-tech hub for a 30% boost to the pace of processor manufacturing advancements. The $53 billion hasn’t been doled out yet, but Applied Materials’ new center is exactly the kind of US research and development facility it’s designed to help.

Chip progress has slowed in recent years because of the physics and engineering challenges of miniaturizing chip circuitry. At the same time, much of the chip making business has moved out of the United States to Taiwan, South Korea and other Asian nations.

The pandemic induced chip shortage revealed global supply chain problems and showed just how much the United States economy relies on overseas manufacturing for arguably the most important components in just about everything with a battery or power plug. The result was the 2022 passage of the CHIPS and Science Act, with its $53 billion subsidy for chip research and manufacturing. So far, the Commerce Department has received 300 statements of interest from applicants hoping to tap into the funds.

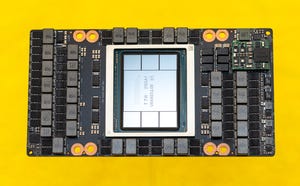

A rendering of the planned Applied Materials’ EPIC Center, a $4 billion research and development to speed chip manufacturing progress

Applied Materials

Applied Materials’ new 180,000-square-foot Equipment and Process Innovation and Commercialization (EPIC) Center is designed to speed up progress and anchor the industry in the US. At the EPIC Center, Applied Materials hopes to speed up both the adoption of new ideas from academia and their transfer to the companies like TSMC, Samsung and Intel that actually build the chips.

Applied Materials is one of the top companies that manufactures chip making equipment. It’s what companies like Intel, Samsung and TSMC buy so they can build the processors in phones, cars, toys, TVs, military equipment, appliances and many more products. It’s on the leading edge of efforts to continue progress in making chip circuitry smaller, more efficient, and more powerful.