Apple is still coming out on top of an incredibly bad smartphone market

The global smartphone market is continuing to contract dramatically, but the premium iPhone is keeping Apple on top.

The global smartphone market is continuing a downturn that has lasted for two years, according to a report from Counterpoint Research seen by AppleInsider. For the eighth consecutive quarter, the global smartphone market has seen a decline.

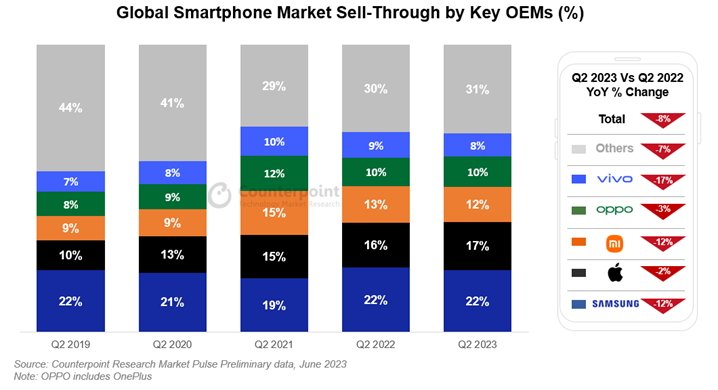

For Q2 2023, the market as a whole saw sell-through down 8% year-on-year, and 5% on a quarter-on-quarter basis.

Counterpoint reckons the market has gone well beyond its rapid growth phase, with lengthening consumer replacement cycles and a matured refurbished market hitting the low to mid-tier market.

Of the top companies in the market, Apple is in second place, with a 2% year-on-year decline. The low level of change means it actually increases its market share to 17% for Q2 2023, and is the biggest percentage level its reached for the second quarter.

By comparison, Samsung saw its shipments decline 12%, but it remains the top performer in Q2 with a 22% market share. Third-place Xiaomi also saw a contraction of 12%, giving it a market share of 12% overall.

While the value end of the market is being hammered, Apple is seemingly benefiting from a “premiumization” wave. The premium segment, deemed to be devices worth $600 or more at wholesale, is thought to be fairly immune to broader constraints, with mature consumers opting for a high-end experience.

The premium segment was the only one that grew year-on-year for the quarter, and more than one in five smartphones sold in the quarter belonged to it.

For Apple, it was seeing increased shares in multiple non-core markets. Counterpoint’s example is India, with a 50% year-on-year growth.

This isn’t an entirely new phenomenon on the market. In March, Counterpoint raised how the premium market saw 1% year-on-year growth in 2022, despite the overall market’s decline.

Despite the “doom and gloom” of the declines, Counterpoint offers hope from its Smartphone Inventory Tracker. Global smartphone inventory has been reaching “healthy levels” for the last five months, giving producers breathing room to launch and push new models in the second half of 2023, which could help accelerate replacement cycles.