Cloud camera security startup Solink raises $60M

Solink, a company that provides physical security systems for businesses, including closed-circuit camera analytics, today announced that it raised $60 million in a Series C round led by Goldman Sachs with participation from Omers Ventures and BDC IT Ventures.

Co-founder and CEO Michael Matta said the cash will be put toward growing Solink’s client base globally and investing in new products.

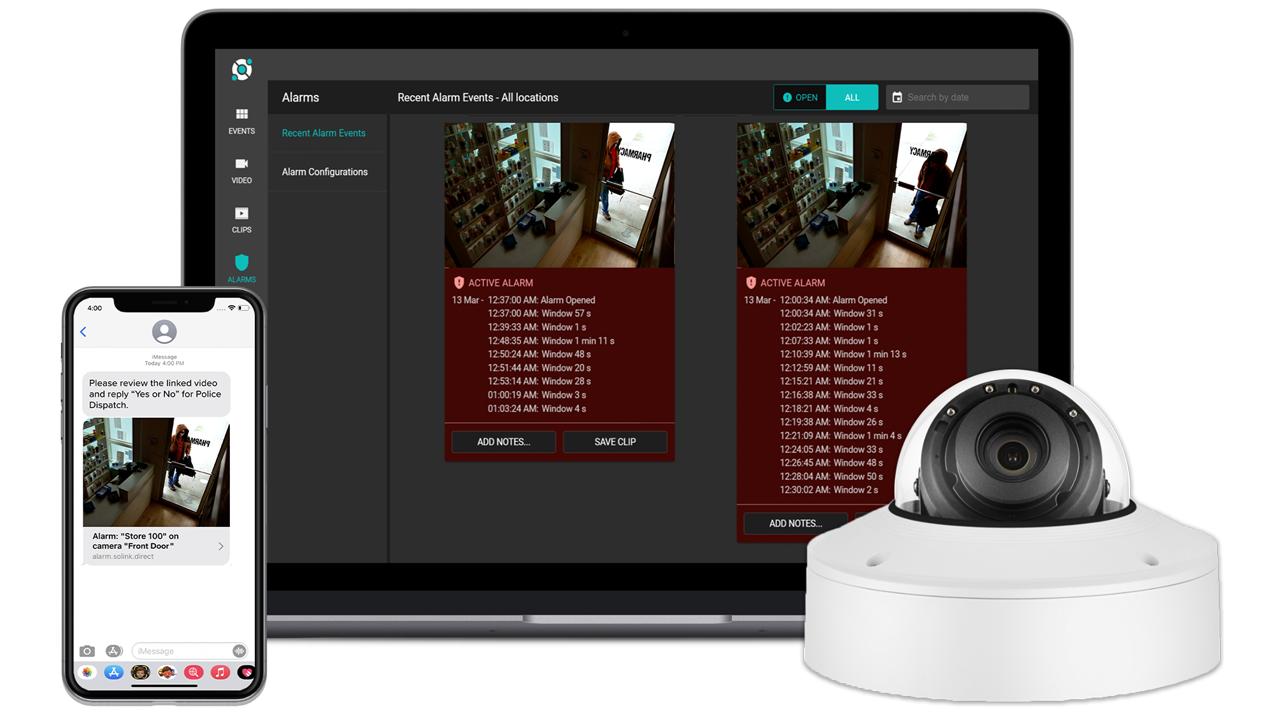

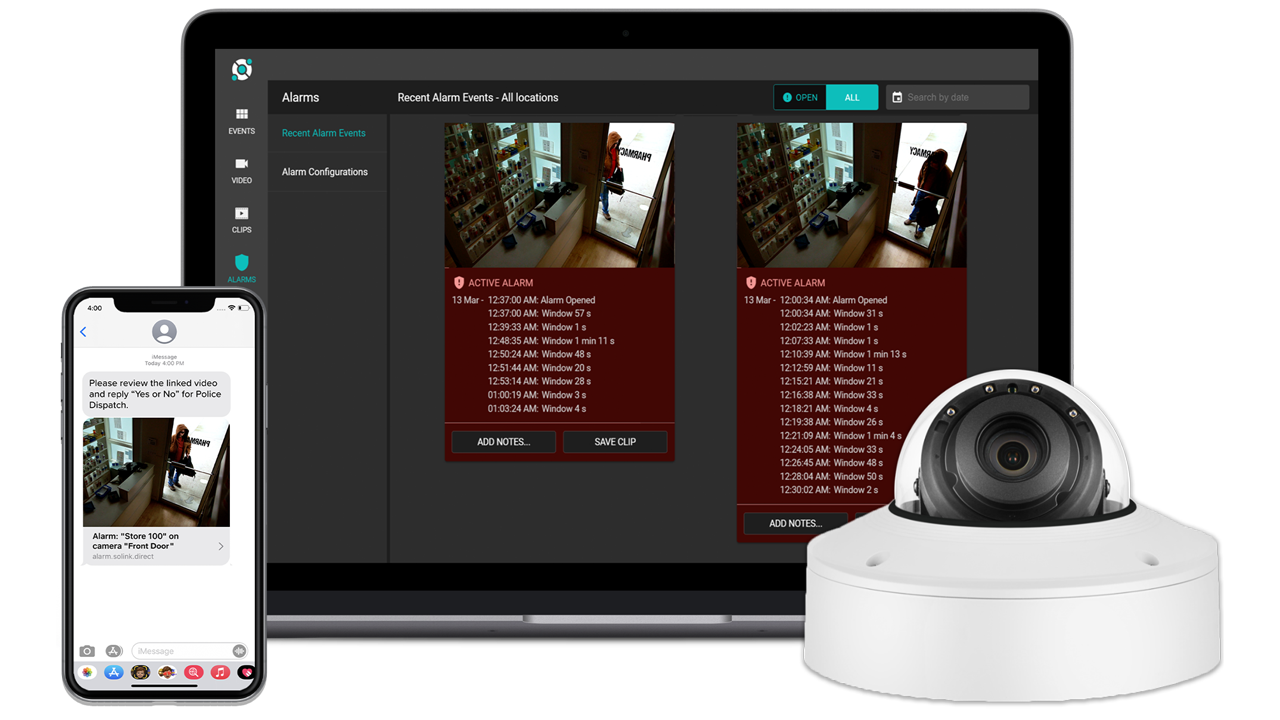

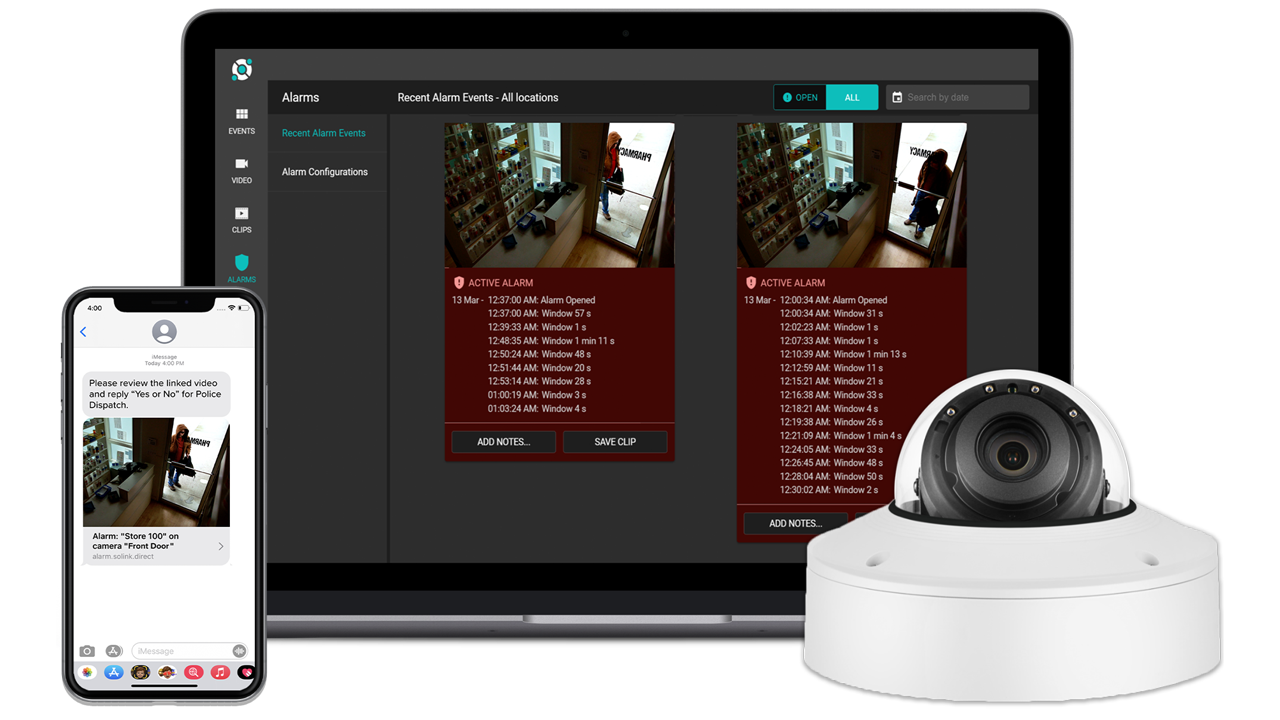

“Solink’s platform meets the unique needs of different industries by offering a solution for forensic security and real-time active security monitoring,” Matta told TechCrunch in an email interview. “Customers across a range of industries use Solink to maximize the value of their existing surveillance infrastructure investments while Solink’s cloud-native infrastructure allows for deeper integration with other business systems, enabling new use cases and improving efficiency.”

Solink was founded in 2010 as a consulting group to help banks and credit unions combat ATM fraud. Combining transaction activity from ATMs with security camera data, the company’s platform helped identify potential ATM skimming attacks in real time.

In 2016, Solink expanded into cloud video security, launching a service-based offering that enriched video feeds with data from other systems, including point-of-sales systems. Today, Solink’s platform allows companies to perform a range of security monitoring tasks, like detecting motion across cameras and navigating from one camera to another without having to know a physical site’s layout.

“Customers can add an unlimited number of users under one subscription and assign unique levels of permissions depending on rank and role,” Matta explained. “The system is configurable, automatically adapting as cameras are added or repositioned, and has the ability to add, remove or modify links manually if required.”

But to this writer, some of the applications of Solink’s service are downright creepy.

In restaurants and retail environments — say, clothing stores — Solink claims to be able to tag specific staff’s customer interactions and monitor per-staff transactions for speed and size, or filter for “unusual” behavior and movement (e.g., foot traffic) in a room. The company also claims that it can identify “threats” using AI, including unauthorized access to buildings and attempted break-ins, and has partnerships with law enforcement for dispatch.

It’s not hard to envision a scenario where a customer uses Solink to invasively surveil their employees — and their customers, for that matter. It wouldn’t be illegal — businesses have a wide berth where it concerns monitoring their workplaces, at least in the U.S. But staffers and patrons might have…thoughts about it.

Image Credits: Solink

The AI component is particularly concerning, considering what history has taught us about AI tech’s susceptibility to bias and other flaws. Consider an algorithm trained to spot “suspicious” activity from a shopper. If the dataset used to train it was imbalanced — say, if it contained an overwhelming amount of footage of Black shoppers stealing — it’d likely flag the overrepresented shoppers more often than others.

Solink says that “certified dispatchers” review video alerts from customers to prevent false alarms and don’t contact emergency services without approval. One wonders, though, how frequently those dispatchers become overwhelmed with alerts — leading to mistakes.

Then there’s the hacking potential. Solink asserts that its platform is highly robust against attacks. But any camera network put on the cloud becomes a potential target for malicious actors. (See: the 2021 breach of Silicon Valley security cam startup Verkada.)

Of course, short of a peek at Solink’s internal metrics, it’s impossible to say where any flaws in the system exist. But that doesn’t appear to have dissuaded customers from signing up for the service.

Solink says its system is monitoring more than 18,000 locations worldwide for more than 800 brands, including Tim Hortons, The Container Store and PGA Tour Superstore. Matta credits the pandemic with the uptake, in part.

“The effect of the pandemic on our business was unusual compared to many others,” Matta said. “First, while many of our customers were slowing down on growth, their usage of the Solink platform increased 3x — mainly because they had to manage their business without being on-site. Second, customers we had that didn’t have Solink in all their locations wanted to add more and we saw rapid expansion without our existing base. Third, customers who were using Solink only for video and security started using it to increase performance, ensuring inventory was in the right place, that employees were properly wearing protective equipment and more.”

To be sure, the market for cloud-managed video surveillance, also known as video surveillance-as-a-service, is growing. A report from Novaira Insights predicts that the sector will grow to $27 billion in 2023, dominated by four suppliers — Hikvision, Dahua, Axis Communications and Motorola Solutions.

To date, Solink, which employs around 230 people, has raised $90 million in venture capital.