Pitch Deck Teardown: ANYbotics’ $50M Series B deck

A couple of weeks ago, Brian wrote about ANYbotics’ $50 million Series B fundraise, which made me realize it’s been a hot minute since I’ve done a robotics teardown. That changes today, since ANYbotics was kind enough to share its pitch deck so we could take a closer look at the highs and lows of four-legged ‘bots.

Since the startup claims it has $150 million in preorders/reservations from gas, oil and chemical companies, and the fact that this is a growth round, I know this is going to be a traction-forward pitch. But there are many ways to weave that narrative. Let’s see how ANYbotics decided to carve that particular turkey.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

ANYbotics sent through a lightly redacted deck that only blurs customer logos and financials. Here are the slides:

- Cover slide

- Mission slide

- Problem slide

- Why now slide

- State of the industry slide

- Company history slide

- Product slide

- Solution slide

- Value proposition slide

- Traction slide [redacted]

- Market size and market projections slide

- Technology slide 1

- Technology slide 2

- Team slide

- Competitive landscape

- Go to market slide

- Financials slide [redacted]

- Testimonials slide [redacted]

- Thank you slide

Three things to love

ANYbotics is a pretty cool company, and I’m always curious how any robotics company tells its story vis-a-vis the goliath in the room: Boston Dynamics is the name that usually springs to mind when it comes to four-legged robots. ANYbotics does a great job on some fronts, though.

Here are three things I loved about the pitch.

A logical evolution

[Slide 4] Nothing is inevitable, but this is a very compelling story. Image Credits: ANYbotics

Experienced robotics investors won’t truly need this slide, but ANYbotics is shrewd to include it. Investment decisions are rarely made in a vacuum, and in a VC firm, a broader partnership usually must be convinced of the viability of an investment. Slides like this can do a lot of the heavy lifting when it comes to telling the story.

This slide tells investors something they already know: Manufacturing robots have been around for a long time, warehousing robots are just finding their stride, and the market is ready for the next step of the evolution. Framing the story of robotics as a journey from structured tasks, towards structured environments and then towards structured problems was an elegant choice, and by outlining the history, the company is already hinting at the problem space and the benefits to customers. It’s a pretty subtle and masterful stroke of storytelling.

Startups should learn from this to contextualize their product in the market. Why are you doing what you do? What came before? How can you extrapolate existing markets and products to show how your company can be successful? Is there any way you can tell the story of your market like ANYbotics did here?

Showing the breadth of opportunities

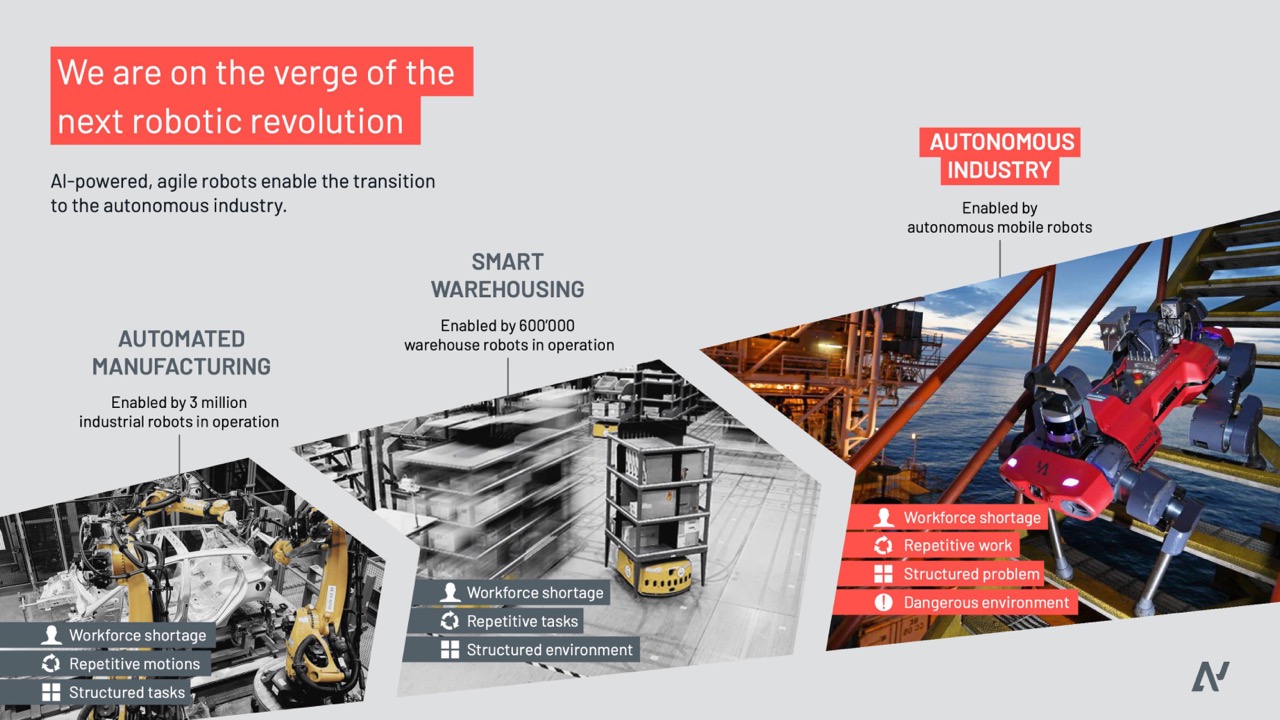

[Slide 9] That’s a lot of use cases. Image Credits: ANYbotics

If this slide had shown up in an early-stage deck, I’d have lambasted the company for a complete lack of focus. But this isn’t a pre-product company hand-waving and saying, “Eh, there’s tons of opportunities, I guess.” This is a company raising $50 million to spur growth. Assuming ANYbotics has a solid go-to-market strategy for each of these value propositions, this slide communicates the utility of autonomous, all-purpose robots that can be used in a ton of situations where not employing a robot can be costly, pose safety risks, or both.

Also: Including the value propositions in the slide helps bring the size of the market to life and illustrate some of the growth opportunities.

I’d have loved to see a slide about the pipeline for selling to these customers to go with this one, but it’s possible that some of that information is on the redacted slides. But as a startup, if you’re saying pretty much everyone could be your customer, you’d best be prepared to back it up and explain how you’re going to reach “everyone.”

IT’S OVER NINE THOUSAND

Forgive the meme, but I wanted to share this heavily redacted slide and what I noticed:

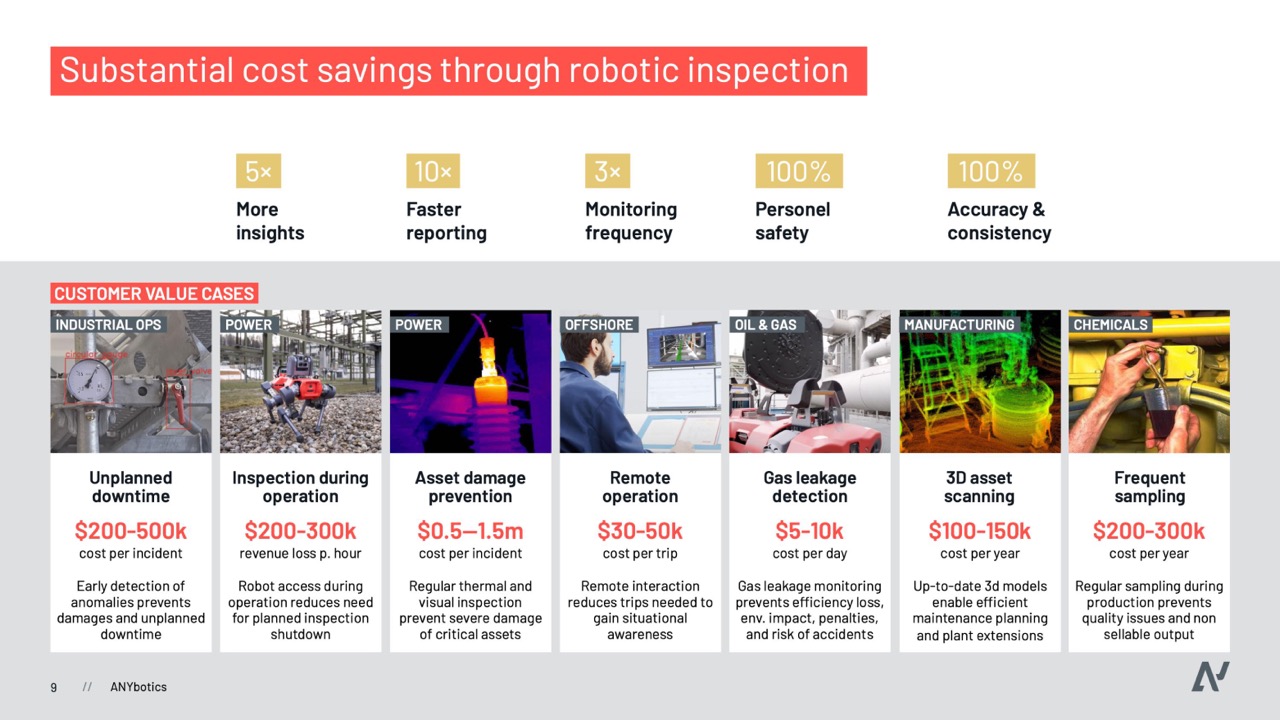

[Slide 10] Expo-bloody-nential for the win. Image Credits: ANYbotics

As expected, ANYbotics raised this growth round based on beefy traction. Look at the monthly and total operating income graph on the top right: Over the course of its history, the company has seen fits and bursts of sales and income, but things went a little silly in the last 20% of the graph.

You have strong traction and a way to continue that traction. Where do I send my investment check?

I would have told this story differently. Instead of cramming this slide with logos and sales partners, I’d have featured the sales order history up front and backed it up with some way of showing that the exponential growth isn’t a fluke, but the result of a repeatable sales approach.

When you tell the story that way, it almost doesn’t matter what the rest of the deck says. You have strong traction and a way to continue that traction. I expect that ANYbotics goes into more detail on this front on slide 16, and if I were a potential investor, I’d find myself asking a very important question: Where do I send my investment check?

In the rest of this teardown, we’ll take a look at three things ANYbotics could have improved or done differently, along with the company’s full pitch deck!

Three things that could be improved

An important part of raising growth funding is showing how you’re going to achieve that growth. Unfortunately, and perhaps understandably, the company redacted some of the slides that help us get the full picture of that growth (slide 17, in particular). Still, reading between and around the lines, I can spot some things that might benefit from a tune-up.