Devolut leverages e-commerce growth in Latin America to develop reverse logistics tool

With the explosion of e-commerce during the global pandemic, companies not only had to adopt Amazon-like shipping skills, but also how to coordinate and manage returns.

In Latin America, the reverse logistics process “is a mess,” according to Agustin Shutte, founder and CEO of Devolut, which provides an end-to-end returns solution for e-commerce sellers.

“It’s dominated by traditional carriers who are not reliable, are super expensive and take forever to take the product back to the merchant,” Shutte told TechCrunch. “This leads to refunds taking 40 to 50 days. Developing a network of return points, like Happy Returns did in the U.S., is something completely unique that no one is doing.”

He started the Mexico-based company earlier this year with Emiliano Monge. This is their second startup together, having previously founded another logistics startup where they saw firsthand how inefficient the return process was.

Devolut is still very much in its early stages, having launched just three months ago. However, the company is already working with 20 B2B clients across three countries.

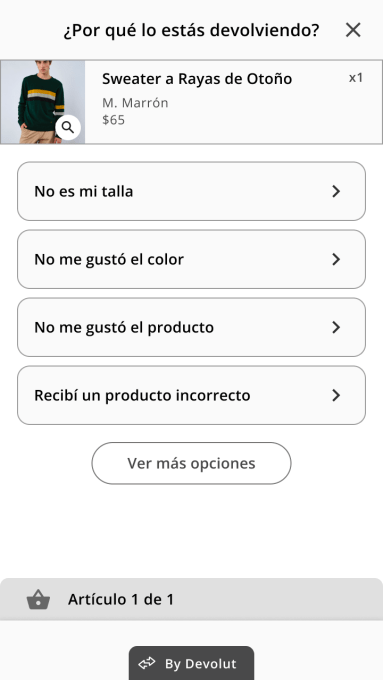

Taking a nod from Happy Returns, Devolut enables sellers a returns option that doesn’t require boxes or labels through a network of what will be “city points,” where those who want to return merchandise can go, for example, a pharmacy or convenience store.

Along with that is software that fully automates the process and technology that assesses item conditions upon receipt. Buyers get a QR code that will be scanned by the clerk at the city point who then puts the item in a plastic bag, scans a preprinted return label and puts the item inside reusable bins, Shutte explained. In most cases, Devolut will be able to provide instant refunds and save merchants up to 50% in returns management costs.

Devolut’s returns dashboard. Image Credits: Devolut

While it is focused on returns, the company is also using AI to promote exchanges instead of refunds so that merchants can retain more revenue, Shutte said. Devolut plans to make money from a monthly software charge for the merchant, a per return charge for managing the process and charging a percentage for any upsells or cross selling.

One of the unique things is that Devolut essentially has government backing for its developing a returns ecosystem. Shutte said some countries, including Mexico, Brazil, Argentina and Colombia, have recently passed laws forcing merchants to take returns from online purchases.

“More importantly than that, is that Amazon and MercadoLibre are setting a new bar in terms of post-purchase experience,” he added. “Just like same- or next-day delivery changed the game in LatAm, now they expect the same experience from every direct-to-consumer brand. Whether the merchants like it or not, returns in LatAm are increasing, and clients are demanding a much better experience. Maybe even more relevant is the fact that it’s been widely proven that a good return experience generates up to 30% in revenues, so the ROI on a solution like ours is 50x to 60x.”

There are some other startups working on this reverse logistics problem, for example, Rever, Loop Returns, ReturnLogic, Seel and Sendcloud. However, Shutte said Devolut’s closest competitor is Reversso, a Chilean company providing each customer a custom portal to manage returns. The main differentiator, according to Shutte, being that Reversso is focused on software rather than an end-to-end solution, while Devolut will have that network of return points.

Today, the company announced that it raised $600,000 in pre-seed funding. Investors in the round include Seedstars International Ventures, FJ Labs, Far Out Ventures, Pareto 20 and Forum Ventures.

Devolut intends to further develop its AI-powered returns and exchange algorithms that generate product recommendations and instant returns, eventually for refunds via its own digital wallet. It is also testing its tool with Sally Beauty’s 240 stores in Mexico.

“Latin America is a region where commerce is growing the most, so we see our solution coming as the next wave: first it was digital payments, second, same-day delivery and now the third wave is post-purchase,” Shutte said. “We see how big the market could become. In the U.S., people buy around 50 to 60 purchases per year, however, in LatAm it is two per year. That could grow 7x compared to today, so that is an enabler to grow.”